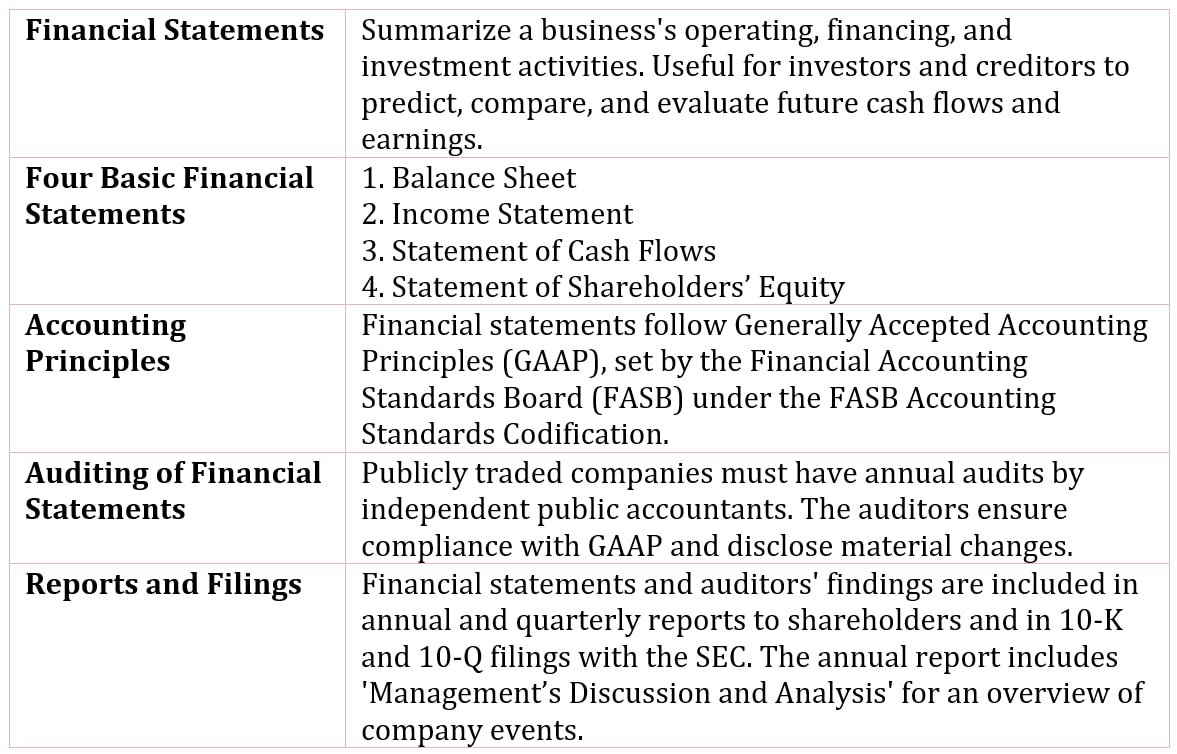

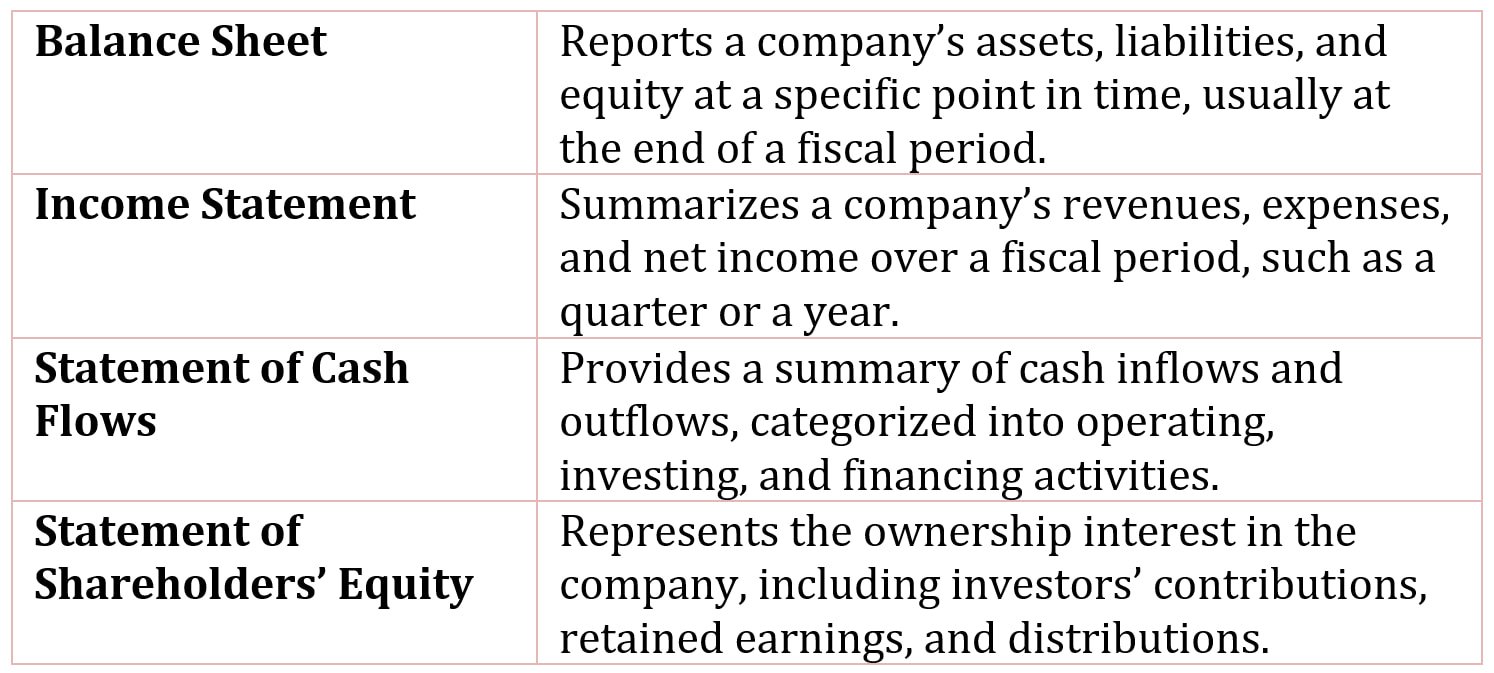

Table of Contents

Assumptions in Creating Financial Statements

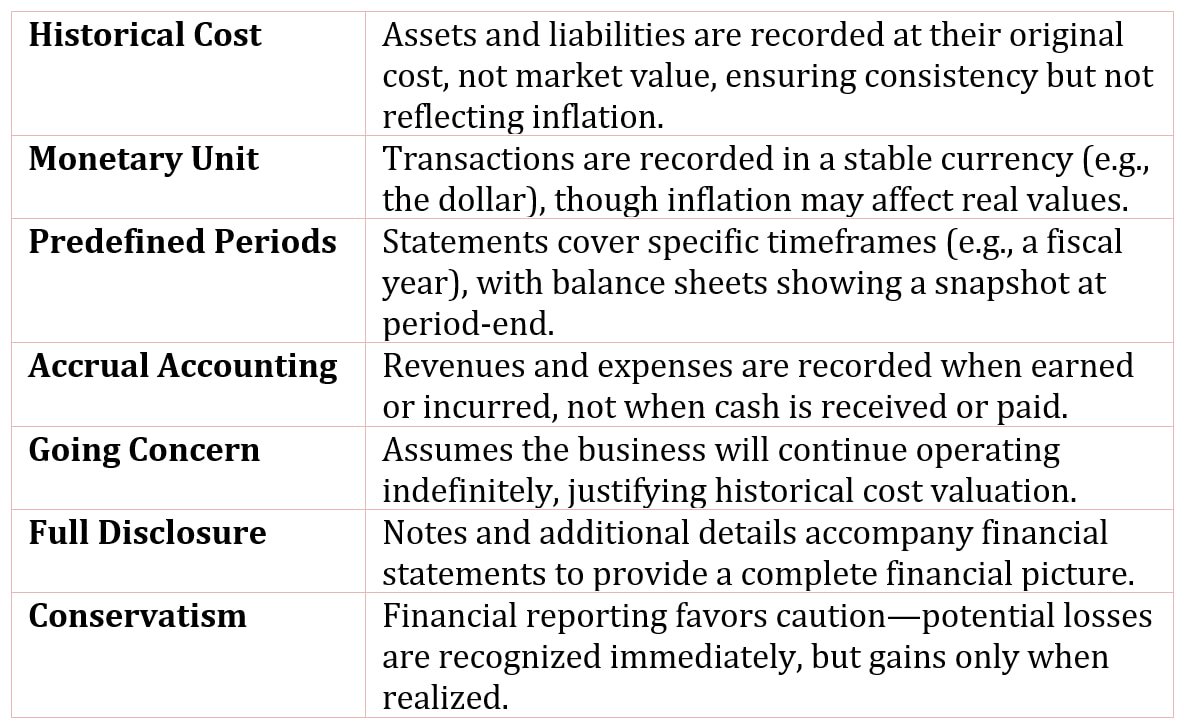

Assumptions in creating financial statements are basic accounting principles ensuring consistency and reliability in reporting.

The financial statements are created using several assumptions that affect how we use and interpret the financial data:

- Transactions are recorded at historical cost

- The appropriate unit of measurement is the dollar

- The statements are recorded for predefined periods of time

- Statements are prepared using accrual accounting and the matching principle

- The business will continue as a going concern

- There is full disclosure

- Statements are prepared assuming conservatism

Transactions are Recorded at Historical Cost

The values shown in the statements are not market or replacement values, but rather reflect the original cost (adjusted for depreciation in the case of a depreciable assets).

The Appropriate Unit of Measurement is the Dollar

While this seems logical, the effects of inflation, combined with the practice of recording values at historical cost, may cause problems in using and interpreting these values.

The Statements are Recorded for Predefined Periods of Time

Generally, statements are produced to cover a chosen fiscal year or quarter, with the income statement and the statement of cash flows spanning a period’s time and the balance sheet and statement of shareholders’ equity as of the end of the specified period. But because the end of the fiscal year is generally chosen to coincide with the low point of activity in the operating cycle, the annual balance sheet and statement of shareholders’ equity may not be representative of values for the year.

Statements are Prepared using Accrual Accounting and the Matching Principle

Most businesses use accrual accounting, where income and revenues are matched in timing so that income is recorded in the period in which it is earned and expenses are reported in the period in which they are incurred in an attempt to generate revenues.

The result of the use of accrual accounting is that reported income does not necessarily coincide with cash flows.

The Business will Continue as a going Concern

The assumption that the business enterprise will continue indefinitely justifies the appropriateness of using historical costs instead of current market values because these assets are expected to be used up over time instead of sold.

There is full Disclosure

Full disclosure requires providing information beyond the financial statements.

The requirement that there be full disclosure means that, in addition to the accounting numbers for such accounting items as revenues, expenses, and assets, narrative and additional numerical disclosures are provided in notes accompanying the financial statements. An analysis of financial statements is, therefore, not complete without this additional information.

Statements are Prepared Assuming Conservatism

In cases in which more than one interpretation of an event is possible, statements are prepared using the most conservative interpretation.