Corporation

A corporation is a legal entity created under state laws through the process of incorporation.

The corporation is an organization capable of entering into contracts and carrying out business under its own name, separate from it owners.

To become a corporation, state laws generally require that a company must do the following:

- File articles of incorporation

- Adopt a set of bylaws

- Form a board of directors

The articles of incorporation specify the legal name of the corporation, its place of business, and the nature of its business. This certificate gives “life” to a corporation in the sense that it represents a contract between the corporation and its owners. This contract authorizes the corporation to issue units of ownership, called shares, and specifies the rights of the owners, the shareholders.

The bylaws are the rules of governance for the corporation. The bylaws define the rights and obligations of officers, members of the board of directors, and shareholders.

In most large corporations, it is not possible for each owner to participate in monitoring the management of the business. Therefore, the owners of a corporation elect a board of directors to represent them in the major business decisions and to monitor the activities of the corporation’s management.

The board of directors, in turn, appoints and oversees the officers of the corporation. Directors who are also employees of the corporation are called insider directors; those who have no other position within the corporation are outside directors or independent directors.

The state recognizes the existence of the corporation in the corporate charter. Once created, the corporation can enter into contracts, adopt a legal name, sue or be sued, and continue in existence forever. Though owners may die, the corporation continues to live.

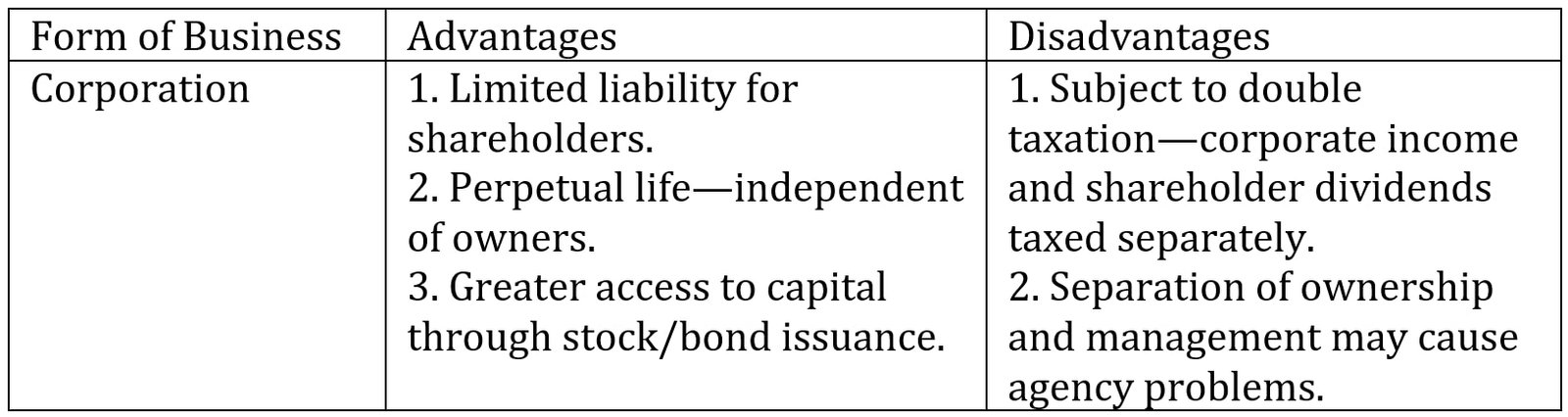

The liability of owners is limited to the amounts they have invested in the corporation through the shares of ownership they purchased. The corporation is a taxable entity. It files its own income tax return and pays taxes on its income.

If the board of directors decides to distribute cash to the owners, that money is paid out of income left over after the corporate income tax has been paid. The amount of that cash payment, or dividend, must also be included in the taxable income of the owners (the shareholders). Therefore, a portion of the corporation’s income (the portion paid out to owners) is subject to double taxation: once as corporate income and once as the individual owner’s income.

The ownership of a corporation, also referred to as stock or equity, is represented as shares of stock.

A corporation that has just a few owners who exert complete control over the decisions of the corporation is referred to as a closely held corporation or a close corporation.

A corporation whose ownership shares are sold outside of a closed group of owners is referred to as a publicly held corporation or a public corporation. Mars Inc., producer of M&M candies and other confectionery products, is a closely held corporation; Hershey Foods, also a producer of candy products among other things, is a publicly held corporation.

The shares of public corporations are freely traded in securities markets, such as the New York Stock Exchange. Hence, the ownership of a publicly held corporation is more easily transferred than the ownership of a proprietorship, a partnership, or a closely held corporation.

Companies whose stock is traded in public markets are required to file an initial registration statement with the Securities and Exchange Commission, a federal agency created to oversee the enforcement of U.S. securities laws.

The statement provides financial statements, articles of incorporation, and descriptive information regarding the nature of the business, the debt and stock of the corporation, the officers and directors, and any individuals who own more than 10% of the stock, among other items.