Partnership

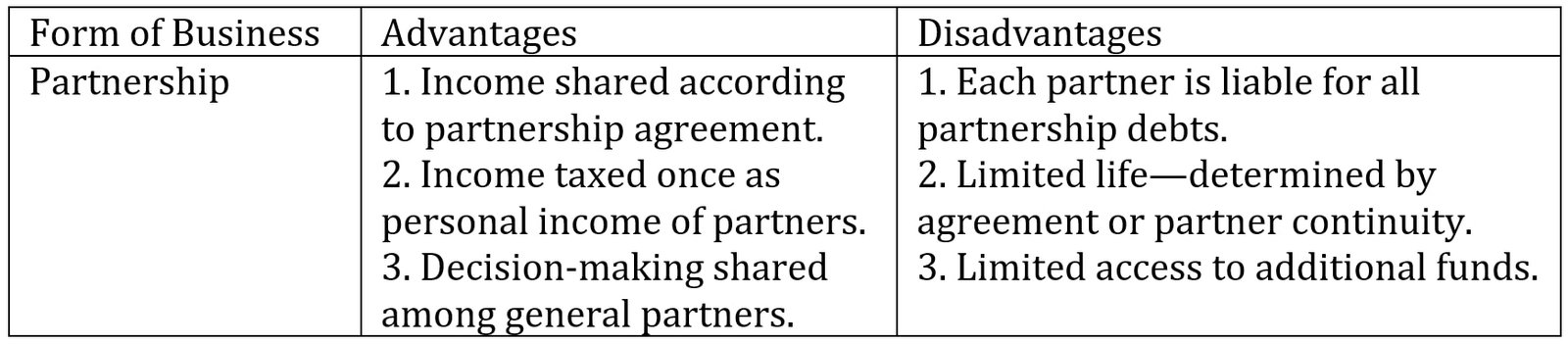

Partnership is a form of business organization in which two or more individuals agree to share the ownership, management, profits, and liabilities of a business. The relationship is typically governed by a partnership agreement, and the partners contribute resources such as capital, skills, or labor to achieve common business objectives.

This structure introduces several considerations:

- Determining who participates in the day-to-day operations of the business.

- Establishing who holds financial responsibility for the debts of the business.

- Defining how the income is distributed among the owners.

- Deciding how the income is taxed.

Some of these matters are resolved through a partnership agreement, while others are governed by applicable laws. The partnership agreement describes how profits and losses are to be shared among the partners, and it details their responsibilities in the management of the business.

Most partnerships are general partnerships, consisting only of general partners who participate fully in the management of the business, share in its profits and losses, and are responsible for its liabilities. Each general partner is personally and individually liable for the debts of the business, even if those debts were contracted by other partners.

A limited partnership consists of at least one general partner and one limited partner. Limited partners invest in the business, but do not participate in its management. A limited partner’s share in the profits and losses of the business is limited by the partnership agreement. In addition, a limited partner is not liable for the debts incurred by the business beyond his or her initial investment.

A partnership is not taxed as a separate entity. Instead, each partner reports his or her share of the business profit or loss on his or her personal income tax return. Each partner’s share is taxed as if it were from a sole proprietorship.

The life of a partnership may be limited by the partnership agreement. For example, the partners may agree that the partnership is to exist only for a specified number of years or only for the duration of a specific business transaction.

The partnership must be terminated when any one of the partners dies, no matter what is specified in the partnership agreement. Partnership interests cannot be passed to heirs; at the death of any partner, the partnership is dissolved and perhaps renegotiated.

One of the drawbacks of partnerships is that a partner’s interest in the business cannot be sold without the consent of the other partners. So a partner who needs to sell his or her interest because of, say, personal financial needs may not be able to do so. Still another problem involves ending a partnership and settling up, mainly because it is difficult to determine the value of the partnership and of each partner’s share.

Another drawback is the partnership’s limited access to new funds. Short of selling part of their own ownership interest, the partners can raise money only by borrowing from banks and here too there is a limit to what a bank will lend a (usually small) partnership.