Limited Liability Company (LLC)

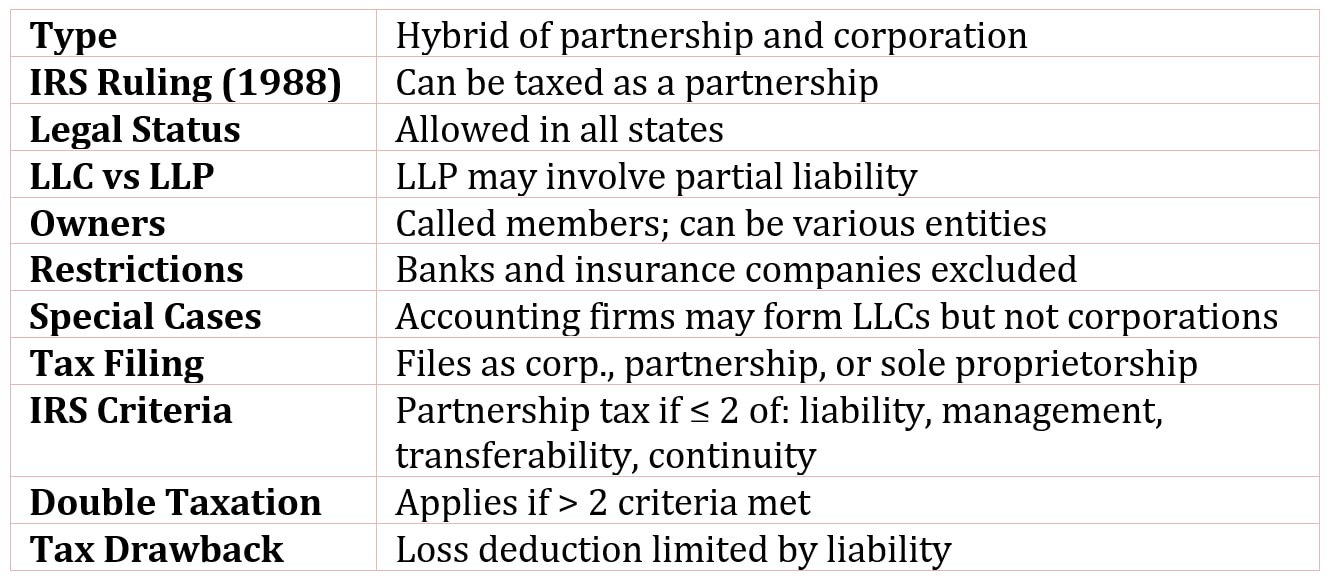

A popular form of business, especially with small businesses, is the hybrid form of business, the limited liability company (LLC) or a limited liability partnership (LLP), which combine the best features of a partnership and a corporation.

In 1988, the Internal Revenue Service (IRS) ruled that the LLC may be treated as a partnership for tax purposes, while retaining its limited liability for its owners. Since this ruling, every state has passed legislation permitting limited liability companies.

The LLC differs slightly from the LLP, because in the latter the partners may be liable for some, but not all, of the debts of the business. However, the distinction is subtle and most rules that apply to an LLC apply to an LLP as well. Though state laws vary slightly, in general, the owners of LLCs have limited liability. Therefore, the LLC and LLP forms represents a hybrid, with the best of both partnerships and corporations.

The owners of an LLC are referred to as members, and these owners may be individuals, partnerships, corporations, or other entities. Though there are few restrictions to who may form an LLC, banks and insurance companies are not permitted to operate as LLCs.

Some types of companies that are prohibited from doing business as a corporation may be permitted to form an LLC. For example, accounting companies may operate as an LLC or an LLP, but cannot operate as a corporation.

The LLC is not considered a form of business for tax purposes, so a company formed as an LLC must file as a corporation, a partnership, or a sole proprietorship. In general, a LLP must file as a partnership.

The IRS considers the LLC to be taxed as a partnership if the company has no more than two of the following characteristics:

- Limited liability

- Centralized management

- Free transferability of ownership interests

- Continuity of life

If the company has more than two of these, it will be treated as a corporation for tax purposes, subjecting the income to taxation at both the company level and the owner’s.

A drawback of an LLC for tax purposes is that if the LLC has a net operating loss, the amount of the loss that is deductible for tax purposes is limited because the owner’s liability is limited.