Table of Contents

The Objective of Financial Management

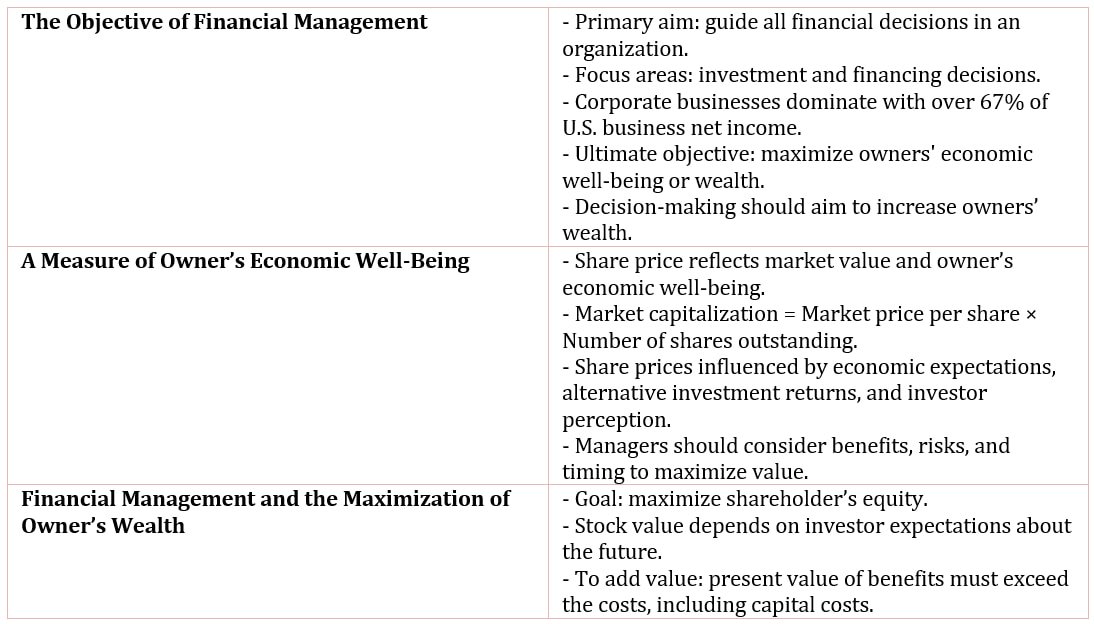

The objective of financial management refers to the primary aim or goal that guides all financial decisions within an organization.

The financial managers are primarily concerned with investment decisions and financing decisions within business organizations. The great majority of these decisions are made within the corporate business structure, which better accommodates growth and is responsible for over 67% of U.S. business net income.

One such issue concerns the objective of financial decision-making. A key consideration is what goal or goals managers have in mind when they choose between financial alternatives-say, between distributing current income among shareholders and investing it to increase future income. There is actually one financial objective: the maximization of the economic well-being, or wealth, of the owners. Whenever a decision is to be made, management should choose the alternative that most increases the wealth of the owners of the business.

A Measure of Owner’s Economic Well-Being

The price of a share of stock at any time, or its market value, represents the price that buyers in a free market are willing to pay for it. The market value of shareholder’s equity is the value of all owner’s interest in the corporation. This market value is also referred to as the stock’s market capitalization, or simply its market cap.

It is calculated as the product of the market value of one share of stock and the number of shares of stock outstanding:

Market value of shareholder’s equity = Market price per share of stock × Number of shares outstanding

The number of shares of stock outstanding is the total number of shares that are owned by shareholders.

The market price of a share is a measure of owner’s economic well-being. An increase in the share price may suggest that management is doing a good job, but this is not always the case. Share prices can often be influenced by factors beyond the control of management. These factors include expectations regarding the economy, returns available on alternative investments (such as bonds), and even how investors view the company and the idea of investing.

These factors influence the price of shares through their effects on expectations regarding future cash flows and investor’s evaluation of those cash flows. Nonetheless, managers can still maximize the value of owner’s equity, given current economic conditions and expectations. They do so by carefully considering the expected benefits, risk, and timing of the returns on proposed investments.

Financial Management and the Maximization of Owner’s Wealth

Financial managers are charged with the responsibility of making decisions that maximize owner’s wealth. For a corporation, that responsibility translates into maximizing the value of shareholder’s equity. If the market for stocks is efficient, the value of a share of stock in a corporation should reflect investor’s expectations regarding the future prospects of the corporation.

The value of a stock will change as investor’s expectations about the future change. For financial manager’s decisions to add value, the present value of the benefits resulting from decisions must outweigh the associated costs, where costs include the costs of capital.