Table of Contents

Stock Repurchases in Finance

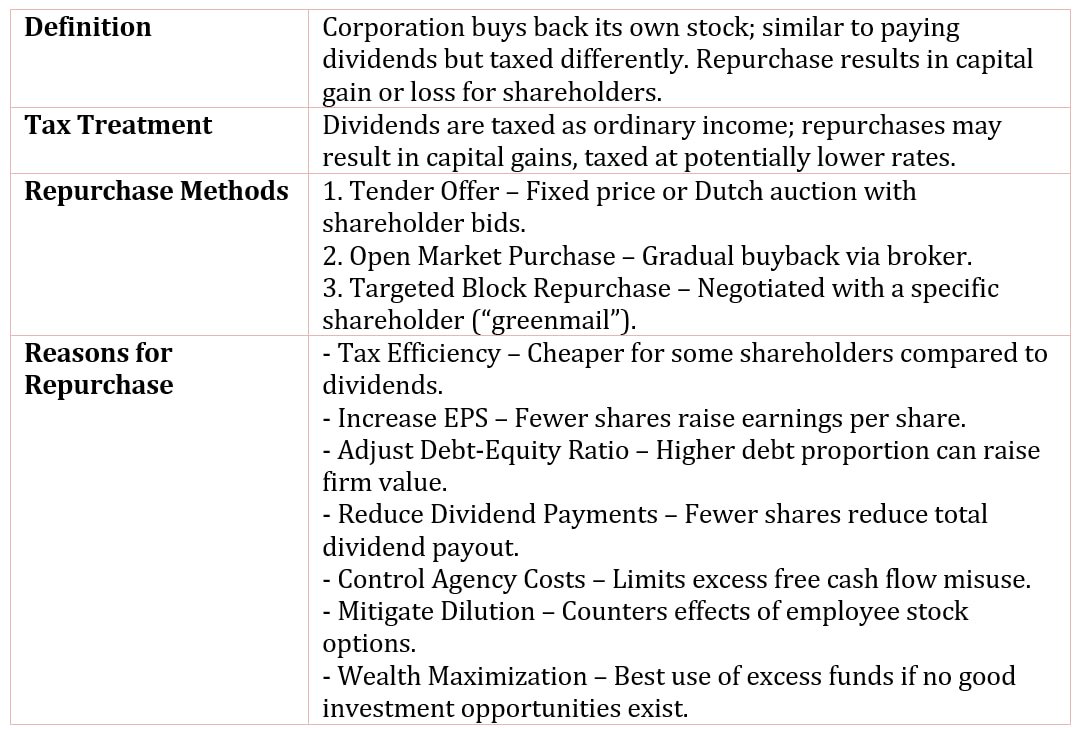

Stock repurchases refer to the process by which a corporation buys back its own outstanding shares from existing shareholders.

Corporations have repurchased their common stock from their shareholders. A corporation repurchasing its own shares is effectively paying a cash dividend, with one important difference: taxes. Cash dividends are ordinary taxable income to the shareholder.

A company’s repurchase of shares, on the other hand, results in a capital gain or loss for the shareholder, depending on the price paid when they were originally purchased. If the shares are repurchased at a higher price, the difference may be taxed as capital gains, which may be taxed at rates lower than ordinary income.

Methods of Repurchases Stock

The company may repurchase its own stock by any of three methods:

- A tender offer

- Open market purchases

- A targeted block repurchase

A tender offer is an offer made to all shareholders, with a specified deadline and a specified number of shares the corporation is willing to buy back.

The tender offer may be a fixed price offer, where the corporation specifies the price it is willing to pay and solicits purchases of shares of stock at that price.

A tender offer may also be conducted as a Dutch auction in which the corporation specifies a minimum and a maximum price, soliciting bids from shareholders for any price within this range at which they are willing to sell their shares. After the corporation receives these bids, they pay all tendering shareholders the maximum price sufficient to buy back the number of shares they want. A Dutch auction reduces the chance that the company pays a price higher than needed to acquire the shares. Dutch auctions are gaining in popularity relative to fixed-price offers.

A corporation may also buy back shares directly in the open market. This involves buying the shares through a broker. A corporation that wants to buy shares may have to spread its purchases over time so as not to drive the share’s price up temporarily by buying large numbers of shares.

The third method of repurchasing stock is to buy it from a specific shareholder. This involves direct negotiation between the corporation and the shareholder. This method is referred to as a targeted block repurchase, since there is a specific shareholder (the “target”) and there are a large number of shares (a “block”) to be purchased at one time. Targeted block repurchases, also referred to as “greenmail,” were used in the 1980s to fight corporate takeovers.

Reasons to Repurchase Stock

Corporations repurchase their stock for a number of reasons.

First, a repurchase is a way to distribute cash to shareholders at a lower cost to both the company and the shareholders than dividends. If capital gains are taxed at rates lower than ordinary income, which until recently has been the case with U.S. tax law, repurchasing is a lower cost way of distributing cash. However, since shareholders have different tax rates-especially when comparing corporate shareholders with individual shareholders-the benefit is mixed. The reason is that some shareholder’s income is tax-free (e.g., pension funds), some shareholders are only taxed on a portion of dividends (e.g., corporations receiving dividends from other corporations), and some shareholders are taxed on the full amount of dividends (e.g., individual taxpayers).

Another reason to repurchase stock is to increase earnings per share. A company that repurchases its shares increases its earnings per share simply because there are fewer shares outstanding after the repurchase. But there are two problems with this motive.

First, cash is paid to the shareholders, so less cash is available for the corporation to reinvest in profitable projects. Second, because there are fewer shares, the earnings pie is sliced in fewer pieces, resulting in higher earnings per share. The individual “slices” are bigger, but the pie itself remains the same size.

Looking at how share prices respond to gimmicks that manipulate earnings, there is evidence that a company cannot fool the market by playing an earnings-per-share game. The market can see through the earnings per share to what is really happening and that the company will have less cash to invest.

Still another reason for stock repurchase is that it could tilt the debtequity ratio so as to increase the value of the company. By buying back stock-thereby reducing equity-the company’s assets are financed to a greater degree by debt. Does this seem wrong? It’s not. To see this, suppose a corporation has a balance sheet consisting of assets of $100 million, liabilities of $50 million, and $50 million of equity. That is, the corporation has financed 50% of its assets with debt, and 50% with equity. If this corporation uses $20 million of its assets to buy back stock worth $20 million, its balance sheet will have assets of $80 million financed by $50 million of liabilities and $30 million of equity. It now finances 62.5% of its assets with debt and 37.5% with equity.

One more reason for a stock repurchase is that it reduces total dividend payments-without seeming to. If the corporation cuts down on the number of shares outstanding, the corporation can still pay the same amount of dividends per share, but the total dividend payments are reduced.

If the shares are correctly valued in the market (there is no reason to believe otherwise), the payment for the repurchased shares equals the reduction in the value of the company-and the remaining shares are worth the same as they were before.

A stock repurchase may also reduce agency costs by reducing the amount of cash the management has on hand. Similar to the argument suggested for dividend payments, repurchasing shares reduces the amount of free cash flow and, therefore, reduces the possibility that management will invest it unprofitably. Many companies use stock buybacks to mitigate the dilution resulting from executive stock options, as well as to shore up their stock price.

Repurchasing shares tends to shrink the company: Cash is paid out and the value of the company is smaller. Can repurchasing shares be consistent with wealth maximization? Yes. If the best use of funds is to pay them out to shareholders, repurchasing shares maximizes shareholders’ wealth. If the company has no profitable investment opportunities, it is better for a company to shrink by paying funds to the shareholders than to shrink by investing in lousy investments.