Table of Contents

Debt Vs Equity

Debt vs equity represent two primary sources of capital through which a company can finance its operations and growth.

The capital structure of a company is some mix of the three sources of capital:

- Debt

- Internally generated equity

- New equity

But what is the right mixture? The best capital structure depends on several factors.

If a company finances its activities with debt, the creditors expect the interest and principal-fixed, legal commitments-to be paid back as promised. Failure to pay may result in legal actions by the creditors. If the company finances its activities with equity, the owners expect a return in terms of cash dividends, an appreciation of the value of the equity interest or, as is most likely, some combination of both.

If the company has abundant earnings, the owners reap all that remains of the earnings after the creditors have been paid. If earnings are low, the creditors still must be paid what they are due, leaving the owners nothing out of the earnings. Failure to pay interest or principal as promised may result in financial distress.

Financial distress is the condition where a company makes decisions under pressure to satisfy its legal obligations to its creditors. These decisions may not be in the best interests of the owners of the company.

With equity financing there is no obligation. Though the company may choose to distribute funds to the owners in the form of cash dividends, there is no legal requirement to do so. Furthermore, interest paid on debt is deductible for tax purposes, whereas dividend payments are not tax deductible.

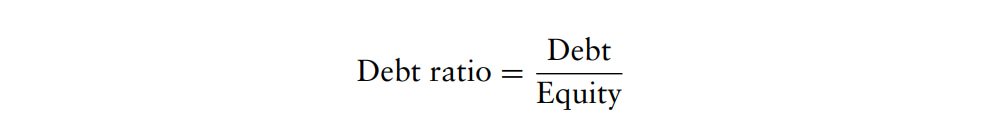

One measure of the extent debt is used to finance a company is the debt ratio, the ratio of debt to equity:

This is relative measure of debt to equity. The greater the debt ratio, the greater is the use of debt for financing operations relative to equity financing.

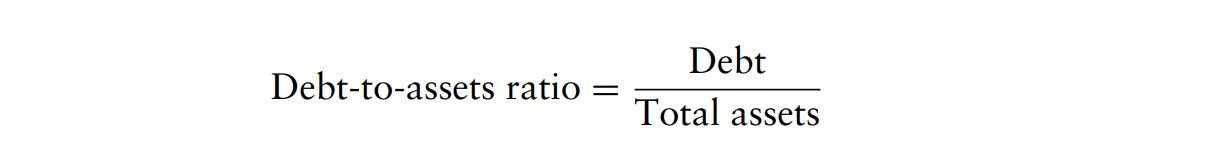

Another measure is the debt-to-assets ratio, which is the extent to which the assets of the company are financed with debt:

This is the proportion of debt in a company’s capital structure, measured using the book, or carrying value of the debt and assets.

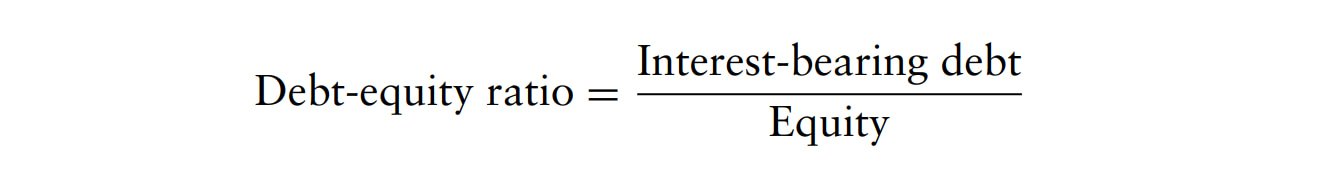

It is often useful to focus on the long-term capital of a company when evaluating the capital structure of a company, looking at the interest-bearing debt of the company in comparison with the company’s equity or with its capital. The capital of a company is the sum of its interest-bearing debt and its equity.

The debt ratio can be restated as the ratio of the interest-bearing debt of the company to the company’s equity:

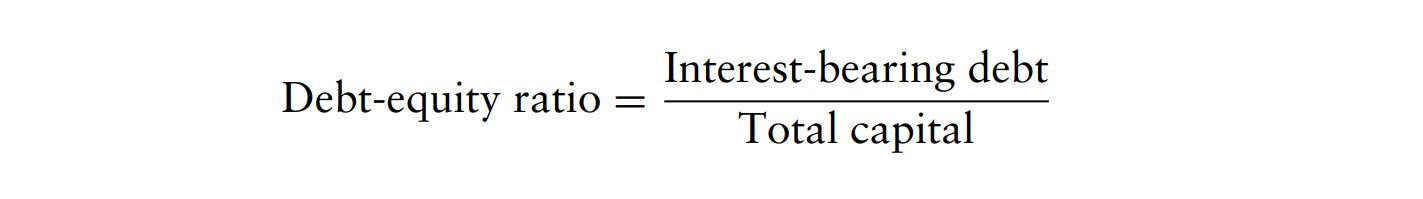

and the debt-to-assets can be restated as the proportion of interest-bearing debt of the company’s capital:

By focusing on the long-term capital, the working capital decisions of a company that affect current liabilities such as accounts payable, are removed from this analysis.

The equity component of all of these ratios is often stated in book, or carrying value terms. However, when taking a markets perspective of the company’s capital structure, it is often useful to compare debt capital with the market value of equity. In this latter formulation, for example, the total capital of the company is the sum of the market value of interest-bearing debt and the market value of equity.

If market values of debt and equity are the most useful for decision making, should management ignore book values? No, because book values are relevant in decision-making also. For example, bond covenants are often specified in terms of book values or ratios of book values. As another example, dividends are distinguished from the return of capital based on the availability of the book value of retained earnings. Therefore, though the focus is primarily on the market values of capital, management must also keep an eye on the book value of debt and equity as well.

There is a tendency for companies in some sectors and industries to use more debt than others.

We can make some generalizations about differences in capital structures across sectors:

- Companies that are more reliant upon research and development for new products and technology-for example, pharmaceutical companies-tend to have lower debt-to-asset ratios than companies without such research and development needs.

- Companies that require a relatively heavy investment in fixed assets tend to have lower debt-to-asset ratios.

Capital Structure and Financial Leverage

Debt and equity financing create different types of obligations for the company.

Capital structure and financial leverage together describe how a company finances its operations using a mix of debt and equity, where the use of debt (financial leverage) can amplify returns to shareholders but also increases the firm’s financial risk due to fixed obligations like interest and principal repayments.

Debt and equity financing create different types of obligations for the company.

Debt financing obligates the company to pay creditors interest and principal-usually a fixed amount-when promised. If the company earns more than necessary to meet its debt payments, it can either distribute the surplus to the owners or reinvest.

Equity financing does not obligate the company to distribute earnings. The company may pay dividends or repurchase stock from the owners, but there is no obligation to do so.

The fixed and limited nature of the debt obligation affects the risk of the earnings to the owners.

The return on assets is the ratio of the company’s net income to its total assets, whereas the return on equity is the ratio of the company’s net income to owner’s equity.

Interest Deductibility

In the United States, the interest a business pays on debt is deductible for tax purposes. Because dividends paid on stock are not deductible, this deductibility of interest on debt provides a distinct advantage to using debt because it effectively lowers the cost of this form of financing.

The deductibility of interest represents a form of a government subsidy of financing activities. By allowing interest to be deducted from taxable income, the government is sharing the company’s cost of debt. Who benefits from this tax deductibility? The owners.

An interesting element introduced into the capital structure decision is the reduction of taxes due to the payment of interest on debt.

Financial Leverage and Risk

The use of financial leverage (that is, the use of debt in financing a company) increases the range of possible outcomes for owners of the company. As we saw previously, the use of debt financing, relative to equity financing, increases both the upside and downside potential earnings for owners. In other words, financial leverage increases the risk to owners.

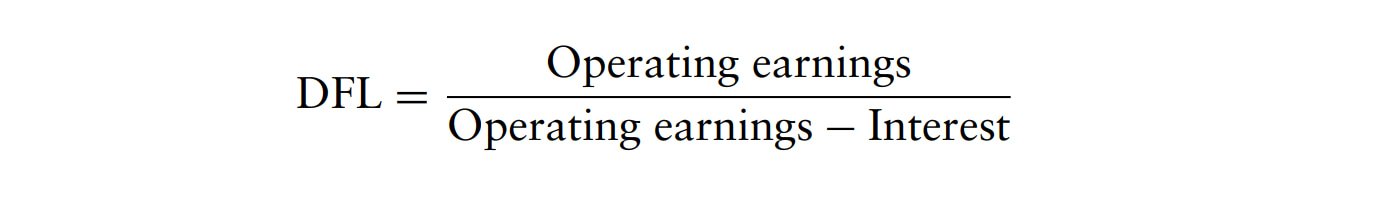

Another way to view the choice of financing is to calculate the degree of financial leverage, denoted by DFL, which is the ratio of operating earnings to earnings after deducting interest:

Equity owners can reap most of the rewards through financial leverage when their company does well. But they may suffer a downside when the company does poorly. What happens if earnings are so low that it cannot cover interest payments? Interest must be paid no matter how low the earnings. How does a company obtain money with which to pay interest when earnings are insufficient?

- By reducing the assets in some way, such as using working capital needed for operations or selling buildings or equipment

- By taking on more debt obligations

- By issuing more shares of stock

Whichever the company chooses, the burden ultimately falls upon the owners.

Leverage and Financial Flexibility

The use of debt also reduces a company’s financial flexibility. A company with debt capacity that is unused, sometimes referred to as financial slack, is more prepared to take advantage of investment opportunities in the future. This ability to exploit these future, strategic options is valuable and, hence, taking on debt increases the risk that the company may not be sufficiently nimble to act on valuable opportunities.

There is evidence that suggests that companies that have more cash flow volatility tend to build up more financial slack and, hence, their investments are not as sensitive to their ability to generate cash flows internally. Rather, the financial slack allows them to exploit investment opportunities without relying on recent internally generated cash flows.

In the context of the effect of leverage on risk, this means that companies that tend to have highly volatile operating earnings may want to maintain some level of financial flexibility by not taking on significant leverage in the form of debt financing.

Governance Value of Debt Financing

A company’s use of debt financing may provide additional monitoring of a company’s management and decisions, reducing agency costs. Agency costs are the costs that arise from the separation of the management and the ownership of a company, which is particularly acute in large corporations. These costs are the costs necessary to resolve the agency problem that may exist between management and ownership of the company and may include the cost of monitoring company management. These costs include the costs associated with the board of directors and providing financial information to shareholders and other investors.

An agency problem that may arise in a company is how effectively a company uses its cash flows. The free cash flow of a company is, basically, its cash flow less any capital expenditures and dividends. One theory that has been widely regarded is that by using debt financing, the company reduces its free cash flows and, therefore, it must reenter the debt market to raise new capital.

It is argued that this benefits the company in two ways:

- First, there are fewer resources under control of management and less chance of wasting these resources in unprofitable investments.

- Second, the continual dependence of the debt market for capital imposes a monitoring or governance discipline on the company that would not have been there otherwise.