Table of Contents

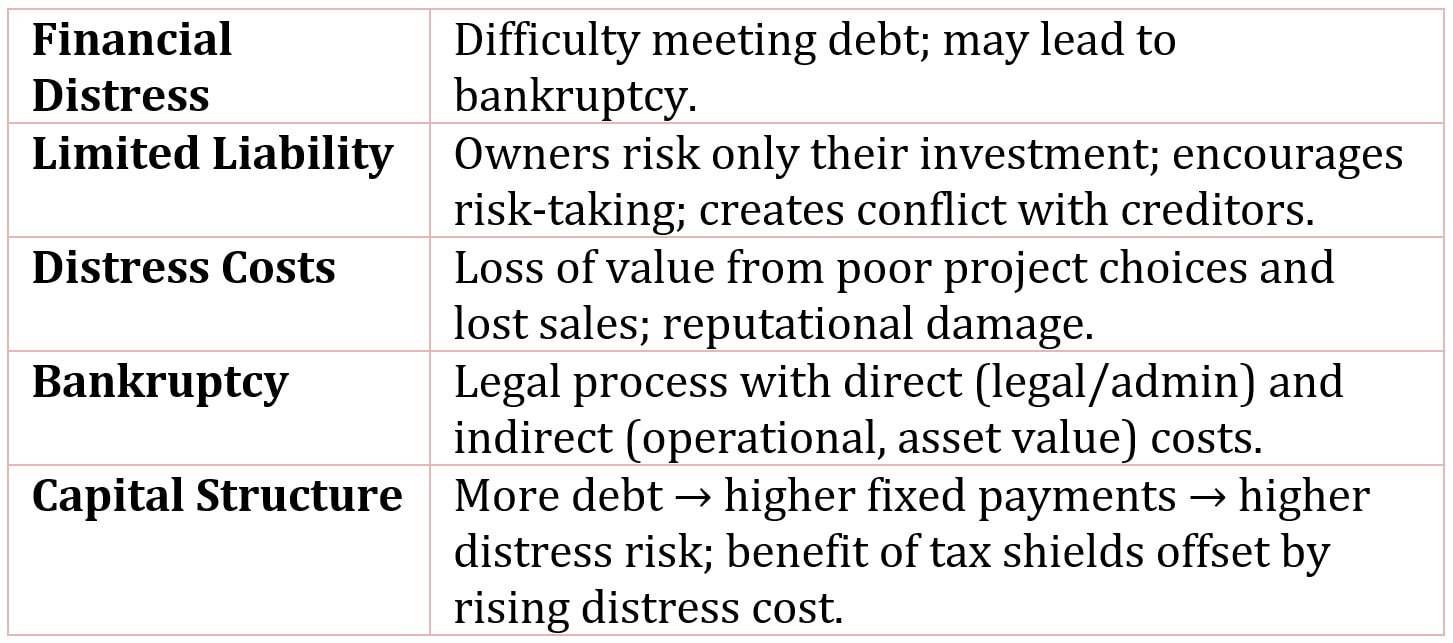

Financial Distress

Financial distress refers to a situation in which a company experiences difficulty in meeting its financial obligations, such as paying interest, principal, or other debts to creditors.

A company that has difficulty making payments to its creditors is in financial distress. Not all companies in financial distress ultimately enter into the legal status of bankruptcy. However, extreme financial distress may very well lead to bankruptcy.

The Role of Limited Liability

Limited liability limits owner’s liability for obligations to the amount of their original investment in the shares of stock.

Limited liability for owners of some forms of business creates a valuable right and an interesting incentive for shareholders. This valuable right is the right to default on obligations to creditors-that is, the right not to pay creditors. Because the most shareholders can lose is their investment, there is an incentive for the company to take on very risky projects: If the projects turn out well, the company pays creditors only what it owes and keeps the remainder and if the projects turn out poorly, it pays creditors what it owes-if there is anything left.

The fact that owners with limited liability can lose only their initial investment-the amount they paid for their shares-creates an incentive for owners to take on riskier projects than if they had unlimited liability: They have little to lose and much to gain.

Owners of a company with limited liability have an incentive to take on risky projects since they can only lose their investment in the company. But they can benefit substantially if the payoff on the investment is high.

For companies whose owners have limited liability, the more the assets are financed with debt, the greater the incentive to take on risky projects, leaving creditors “holding the bag” if the projects turn out to be unprofitable. This is a problem for it poses a conflict of interest between shareholder’s interests and creditor’s interests.

The investment decisions are made by management (who represent the shareholders) and, because of limited liability, there is an incentive for management to select riskier projects that may harm creditors who have entrusted their funds (by lending them) to the company.

The right to default is a call option: The owners have the option to buy back the entire company by paying off the creditors at the face value of their debt. As with other types of options, the option is more valuable, the riskier the cash flows. However, creditors are aware of this and demand a higher return on debt (and hence a higher cost to the company).

Jensen and Meckling analyze the agency problems associated with limited liability. They argue that creditors are aware of the incentives the company has to take on riskier projects. Creditors will demand a higher return and may also require protective provisions in the loan contract. The result is that shareholders ultimately bear a higher cost of debt.

Costs of Financial Distress

The costs related to financial distress without legal bankruptcy can take different forms. For example, to meet creditor’s demands, a company takes on projects expected to provide a quick payback. In doing so, the financial manager may choose a project that decreases owner’s wealth or may forgo a profitable project.

Another cost of financial distress is the cost associated with lost sales. If a company is having financial difficulty, potential customers may shy away from its products because they may perceive the company unable to provide maintenance, replacement parts, and warranties. Lost sales due to customer concerns represent a cost of financial distress-an opportunity cost, something of value (sales) that the company would have had if it were not in financial difficulty.

Bankruptcy and Bankruptcy Costs

When a company is having difficulty paying its debts, there is a possibility that creditors will foreclose (that is, demand payment) on loans, causing the company to sell assets that could impair or cease the company’s operations. But if some creditors force payment, this may disadvantage other creditors. So what has developed is an orderly way of dealing with the process of the company paying its creditors-the process is called bankruptcy.

Bankruptcy in the United States is governed by the Bankruptcy Code, which is found under U.S. Code.

We can classify bankruptcy costs into:

- Direct costs

- Indirect costs

Direct costs include the legal, administrative, and accounting costs associated with the filing for bankruptcy and the administration of bankruptcy.

The indirect costs of bankruptcy are more difficult to evaluate.

Operating a company while in bankruptcy is difficult, since there are often delays in making decisions, creditors may not agree on the operations of the company, and the objectives of creditors may be at variance with the objective of efficient operation of the company.

Another indirect cost of bankruptcy is the loss in value of certain assets. If the company has assets that are intangible or for which there are valuable growth opportunities or options, it is less likely to borrow because the loss of value in the case of financial distress is greater than, say, a company with marketable assets. Because many intangible assets derive their value from the continuing operations of the company, the disruption of operations during bankruptcy may change the value of the company.

The extent to which the value of a business enterprise depends on intangibles varies among industries and among companies; so the potential loss in value from financial distress varies as well. For example, a drug company may experience a greater disruption in its business activities, than say, a steel manufacturer, since much of the value of the drug company may be derived from the research and development that leads to new products.

Financial Distress and Capital Structure

The relationship between financial distress and capital structure is simple: As more debt financing is used, fixed legal obligations increase (interest and principal payments), and the ability of the company to satisfy these increasing fixed payments decreases. Therefore, as more debt financing is used, the probability of financial distress and then bankruptcy increases.

For a given decrease in operating earnings, a company that uses debt to a greater extent in its capital structure (that is, a company that uses more financial leverage), has a greater risk of not being able to satisfy the debt obligations and increases the risk of earnings to owners.

Another factor to consider in assessing the probability of financial distress is the business risk of the company. As discussed earlier, the business risk interacts with the financial risk to affect the risk of the company.

Management’s concern in assessing the effect of financial distress on the value of the company is the present value of the expected costs of financial distress. And the present value depends on the probability of financial distress: The greater the probability of financial distress, the greater the expected costs of financial distress.

The present value of the costs of financial distress increases with the increasing relative use of debt financing because the probability of financial distress increases with increases with financial leverage.

In other words, as the debt ratio increases, the present value of the costs of financial distress

increases, lessening some of the value gained from the use of tax deductibility of interest expense.

Management does not know the precise manner in which the probability of distress increases as the debt-to-equity ratio increases. Yet, it is reasonable to think that as the company increases its use of debt, relative to equity, in financing its operations and assets:

- The likelihood of distress increases.

- The benefit from the tax deductibility of interest increases.

- The present value of the cost of financial distress increases.