Motivating Managers: Executive Compensation

Executive compensation refers to the financial and non-financial rewards provided to top management of a company, including salaries, bonuses, stock options, and other benefits.

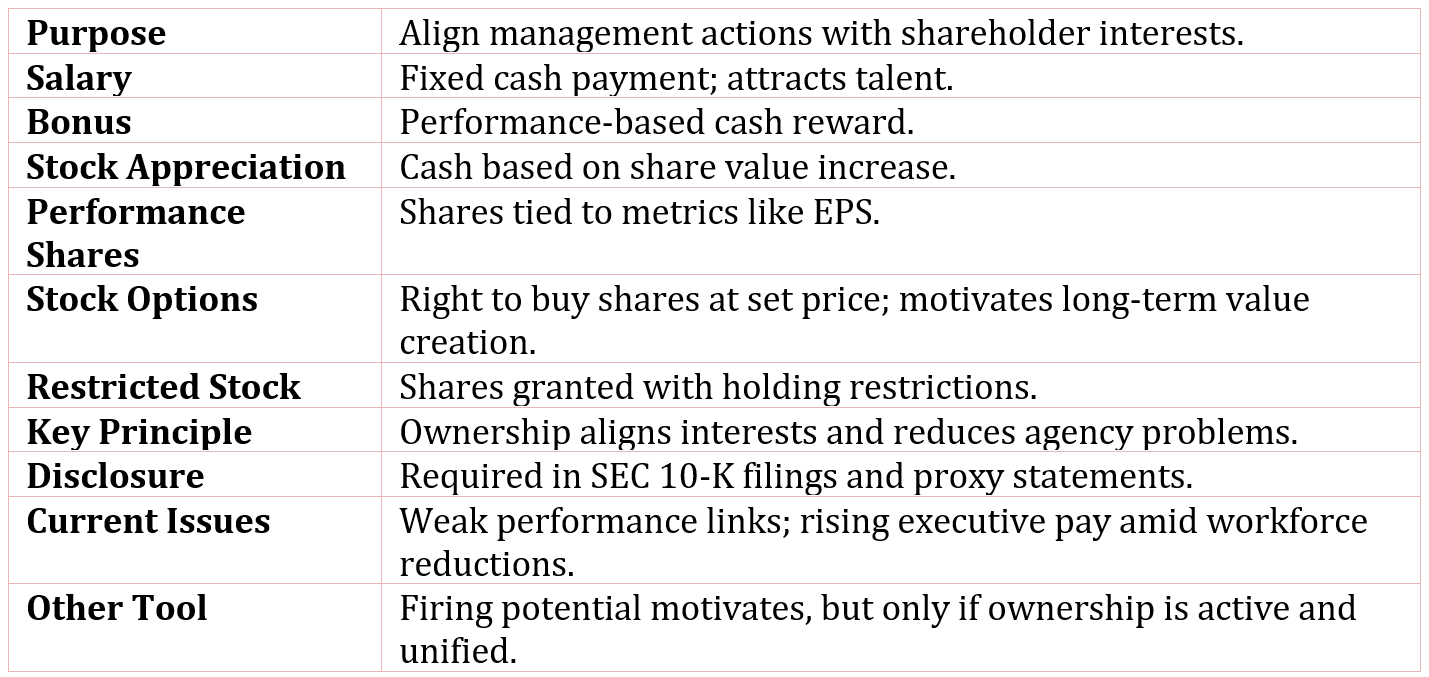

One way to encourage management to act in shareholder’s best interests, and so minimize agency problems and costs, is through executive compensation-how top management is paid.

There are several different ways to compensate executives, including:

- Salary: The direct payment of cash of a fixed amount per period.

- Bonus: A cash reward based on some performance measure, say, earnings of a division or the company.

- Stock appreciation right: A cash payment based on the amount by which the value of a specified number of shares has increased over a specified period of time (supposedly due to the efforts of management).

- Performance shares: Shares of stock given the employees, in an amount based on some measure of operating performance, such as earnings per share.

- Stock option: The right to buy a specified number of shares of stock in the company at a stated price-referred to as an exercise price at some time in the future. The exercise price may be above, at, or below the current market price of the stock.

- Restricted stock grant: The grant of shares of stock to the employee at low or no cost, conditional on the shares not being sold for a specified time.

The salary portion of the compensation-the minimum cash payment an executive receives-must be enough to attract talented executives. But a bonus should be based on some measure of performance that is in the best interests of shareholders-not just on the past year’s accounting earnings. For example, a bonus could be based on gains in market share.

The basic idea behind stock options and restricted stock grants is to make managers owners, since the incentive to consume excessive perks and to shirk are reduced if managers are also owners.

As owners, managers not only share the costs of perks and shirks, but they also benefit financially when their decisions maximize the wealth of owners. Hence, the key to motivation through stock is not really the value of the stock, but rather ownership of the stock. For this reason, stock appreciation rights and performance shares, which do not involve an investment on the part of the recipients, are not effective motivators.

Stock options do work to motivate performance if they require owning the shares over a long time period; are exercisable at a price significantly above the current market price of the shares, thus encouraging managers to get the share price up, and require managers to tie up their own wealth in the shares. Unfortunately, executive stock option programs have not always been designed in ways to sufficiently motivate executives.

Publicly-traded companies must disclose the compensation in a table, as well as provide a discussion of key elements in the “Compensation Discussion and Analysis” portion of their SEC 10-K filing and proxy statements.

The table provides the investor with information on the compensation that is both cash-based and stock-based, with details on the options granted and exercised by the top paid employees. This table enables the comparison year-to-year of each of the elements of a manager’s compensation.

Currently, there is a great deal of concern in some corporations because executive compensation is not linked to performance.

In recent years, many U.S. companies have downsized, restructured, and laid off many employees and allowed the wages of employees who survive the cuts to stagnate. At the same time, corporations have increased the pay of top executives through both salary and lucrative stock options. If these changes lead to better value for shareholders, shouldn’t the top executives be rewarded?

There are two issues here:

- Such a situation results in anger and disenchantment among both surviving employees and former employees.

- The downsizing, restructuring, and lay-offs may not result in immediate (or even, eventual) increased profitability.

Owners have one more tool with which to motivate management-the threat of firing. As long as owners can fire managers, managers will be encouraged to act in the owner’s interest. However, if the owners are divided or apathetic-as they might be in large corporations-or if they fail to monitor management’s performance and the reaction of directors to that performance, the threat may not be credible. The removal of a few poor managers can, however, make this threat palpable.