Sole Proprietorship

Sole Proprietorship is a form of business ownership where a single individual owns, manages, and controls the entire business.

It is not legally separate from the owner, meaning the owner bears full responsibility for all profits, losses, and liabilities. This structure is the simplest and most common type of business entity, requiring minimal regulatory compliance.

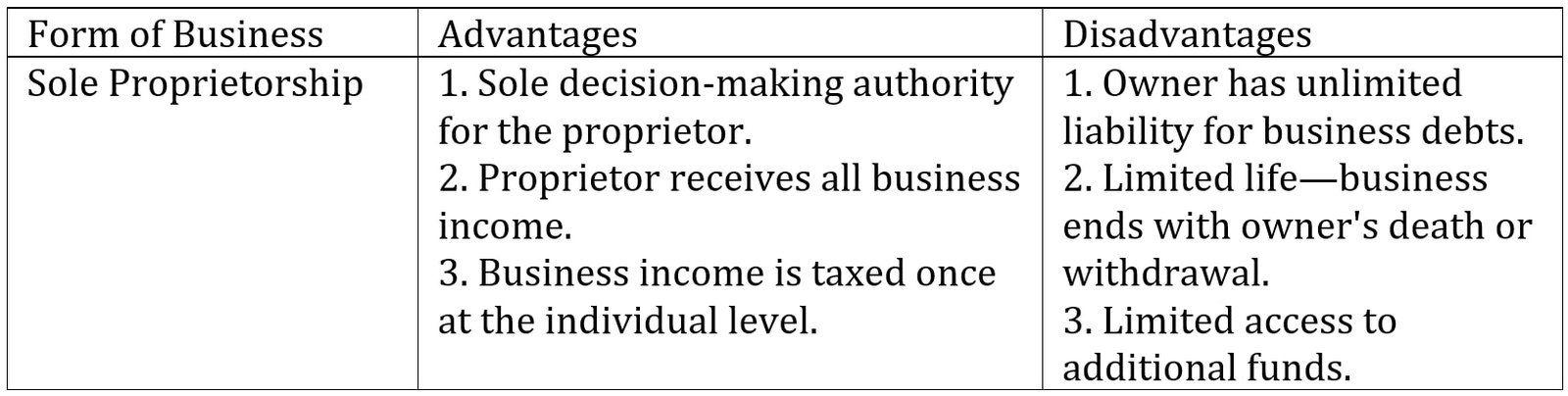

A sole proprietorship is a business entity owned by one party, and is the simplest of the forms of business:

- It is easy to form.

- The business income is taxed along with the owner’s other income.

- The owner is liable for the debts of the business.

- The owner controls the decisions of the business.

- The business ends when the owner does.

The sole proprietorship is often the starting point for a small, fledgling business. But a sole proprietorship is often limited in its access to funds beyond bank loans. Another form of business that offers additional sources of funds is the partnership.