Cost of Capital in Finance

Cost of Capital refers to the required return necessary to make a capital budgeting project worthwhile, representing the cost of obtaining funds through debt or equity.

The capital structure of a company is intertwined with the company’s cost of capital. The cost of capital is the return that must be provided for the use of an investor’s funds. If the funds are borrowed, the cost is related to the interest that must be paid on the loan. If the funds are equity, the cost is the return that investors expect, both from the stock’s price appreciation and dividends.

The cost of capital is a marginal concept. That is, the cost of capital is the cost associated with raising one more dollar of capital.

There are two reasons for determining a corporation’s cost of capital:

- First, the cost of capital is often used as a starting point (a benchmark) for determining the cost of capital for a specific project. Often in capital budgeting decisions, the company’s cost of capital is adjusted upward or downward depending on whether the project’s risk is more than or less than the company’s typical project.

- Second, many of a company’s projects have risk similar to the risk of the company as a whole. So the cost of capital of the company is a reasonable approximation for the cost of capital of one of its projects that are under consideration for investment.

A company’s cost of capital is the cost of its long-term sources of funds: debt, preferred stock, and common stock. And the cost of each source reflects the risk of the assets the company invests in.

A company that invests in assets having little risk will be able to bear lower costs of capital than a company that invests in assets having a high risk. Moreover, the cost of each source of funds reflects the hierarchy of the risk associated with its seniority over the other sources.

For a given company, the cost of funds raised through debt is less than the cost of funds from preferred stock which, in turn, is less than the cost of funds from common stock. This is because creditors have seniority over preferred shareholders, who have seniority over common shareholders. If there are difficulties in meeting obligations, the creditors receive their promised interest and principal before the preferred shareholders who, in turn, receive their promised dividends before the common shareholders.

For a given company, debt is less risky than preferred stock, which is less risky than common stock. Therefore, preferred shareholders require a greater return than the creditors and common shareholders require a greater return than preferred shareholders.

Figuring out the cost of capital requires us to determine the cost of each source of capital the company expects to use, along with the relative amounts of each source of capital the company expects to raise. Putting together all these pieces, the company can then estimate the marginal cost of raising additional capital.

We estimate the company’s cost of capital in three steps:

- Determine the proportion of each source of capital that the company intends to use.

- Estimate the cost of each source of capital.

- Calculate the weighted average of the costs of capital.

We estimate the proportion of each source of capital using the company’s target capital structure. We do not use book values of capital from the balance sheet because these are historical costs and may not represent how the company intends to raise new capital. In calculating the cost of each financing source, we estimate the cost of raising additional capital from each source; in other words, their marginal costs. The cost of debt is the after-tax cost of debt, which we can estimate by using current yields on the company’s debt, multiplied by one minus the company’s marginal tax rate.

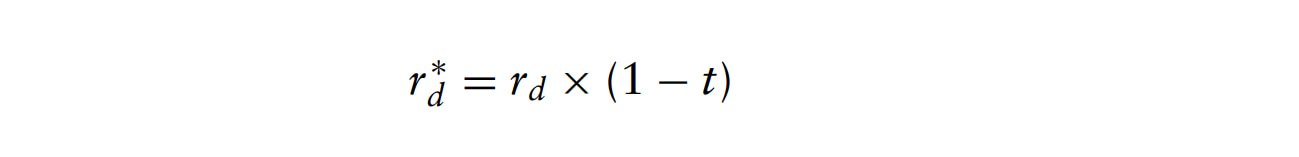

If rd is the marginal cost of debt before adjusting for taxes and t is the marginal tax rate, then the after-tax cost of debt, r∗d , is:

Why adjust for taxes? Because interest on debt is deductible for tax purposes, so the cost of the debt is not the current yield, but rather the yield adjusted for the tax deductibility of interest.

We can estimate the cost of preferred stock by using current yields on the company’s preferred stock, if applicable. However, the cost of equity is by far much more difficult to estimate.

There are several models available for estimating the cost of equity, including the dividend valuation model and the capital asset pricing model. What is critical to understand is that these different models can generate significantly different estimates for the cost of common stock and, as a result, the estimated cost of capital will be highly sensitive to the model selected.

In the case of both preferred stock and common stock, there is no adjustment for taxes because the distributions to shareholders are paid out of after-tax dollars. In other words, dividends paid on stock are not tax deductible.

The last step is to weight the cost of each source of funding by the proportion of that source in the target capital structure.

As a company adjusts its capital structure, its cost of capital also changes. Up to a point, using more debt relative to equity will lower the cost of capital because the after-tax cost of debt is less than the cost of equity. There is some point, however, when the likelihood and, hence, cost of financial distress increases and may in fact outweigh the benefit from taxes. After this point-wherever this may be-the cost of both debt and equity increases because both are much riskier.

Therefore, the trade-off theory of capital structure dictates that as the company uses more debt relative to equity, the value of the company is enhanced from the benefit of the interest tax shields. But the theory also states that there is some point at which the likelihood of financial distress increases such that there is an ever-increasing likelihood of bankruptcy.

Therefore:

- The value of the company declines as more and more debt is used, relative to equity.

- The cost of capital increases because the costs of the different sources of capital increase.

Though the trade-off theory simplifies the world too much, it gives the management an idea of the trade-offs involved. Introduce the value of financial flexibility and the governance value of debt, and management has the key inputs to consider in the capital structure decision.