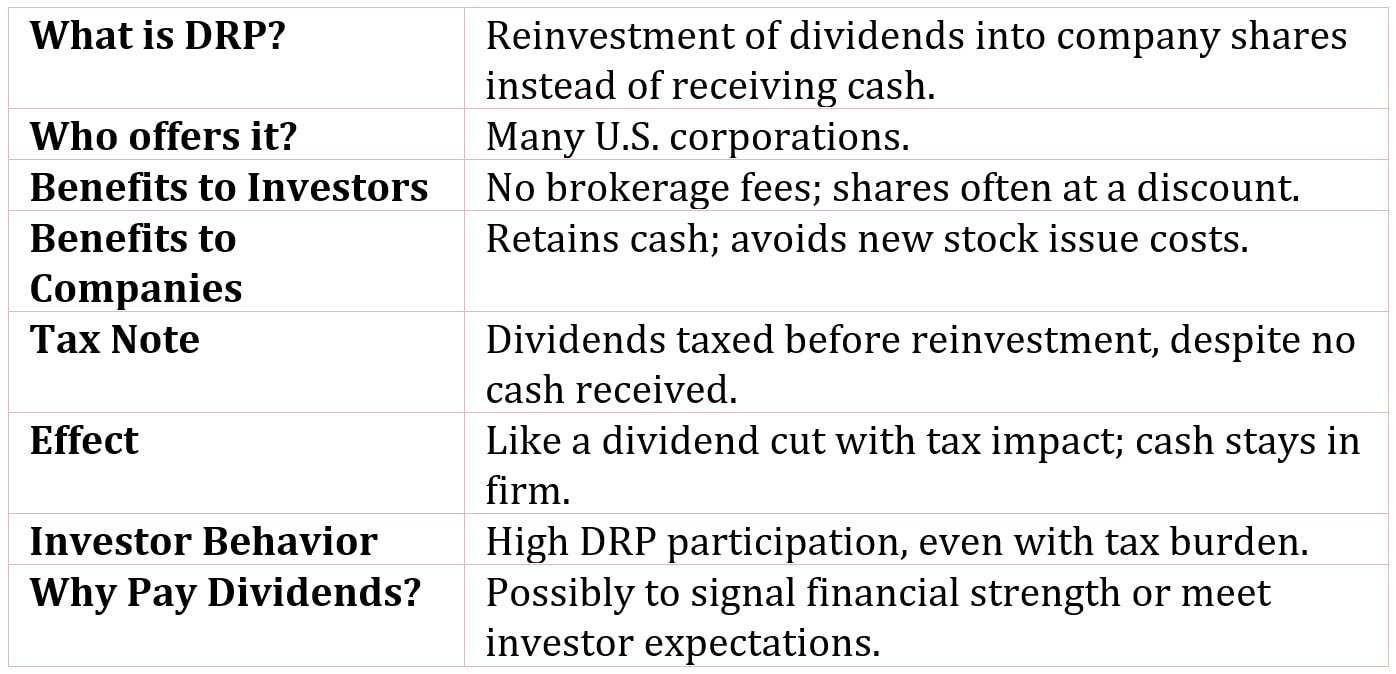

Dividend Reinvestment Plans

Dividend reinvestment plans (DRPs or DRIPs) refer to corporate programs that allow shareholders to reinvest their cash dividends into additional shares of the issuing company, rather than receiving the dividends in cash.

Many U.S. corporations allow shareholders to reinvest automatically their dividends in the shares of the corporation paying them.

A dividend reinvestment plan (DRP or DRIP) is a program that allows shareholders to reinvest their dividends, buying additional shares of stock of the company instead of receiving the cash dividend.

A DRP offers benefits to both shareholders and the corporation:

- Shareholders buy shares without transactions costs-broker’s commissions-and at a discount from the current market price.

- The corporation retains cash without the cost of a new stock issue.

One stickler in all this, however, is that the dividends are taxed as income before they are reinvested, even though the shareholders never see the dividend.

The result is similar to a dividend cut, but with a tax consequence for the shareholders: The cash flow that would have been paid to shareholders is plowed back into the corporation.

Many corporations find high rates of participation in DRPs. If so many shareholders want to reinvest their dividends-even after considering the tax consequences-why is the corporation paying dividends? This suggests that there is some rationale, such as signaling, that compels corporations to pay dividends.