Table of Contents

Stock Distributions in Finance

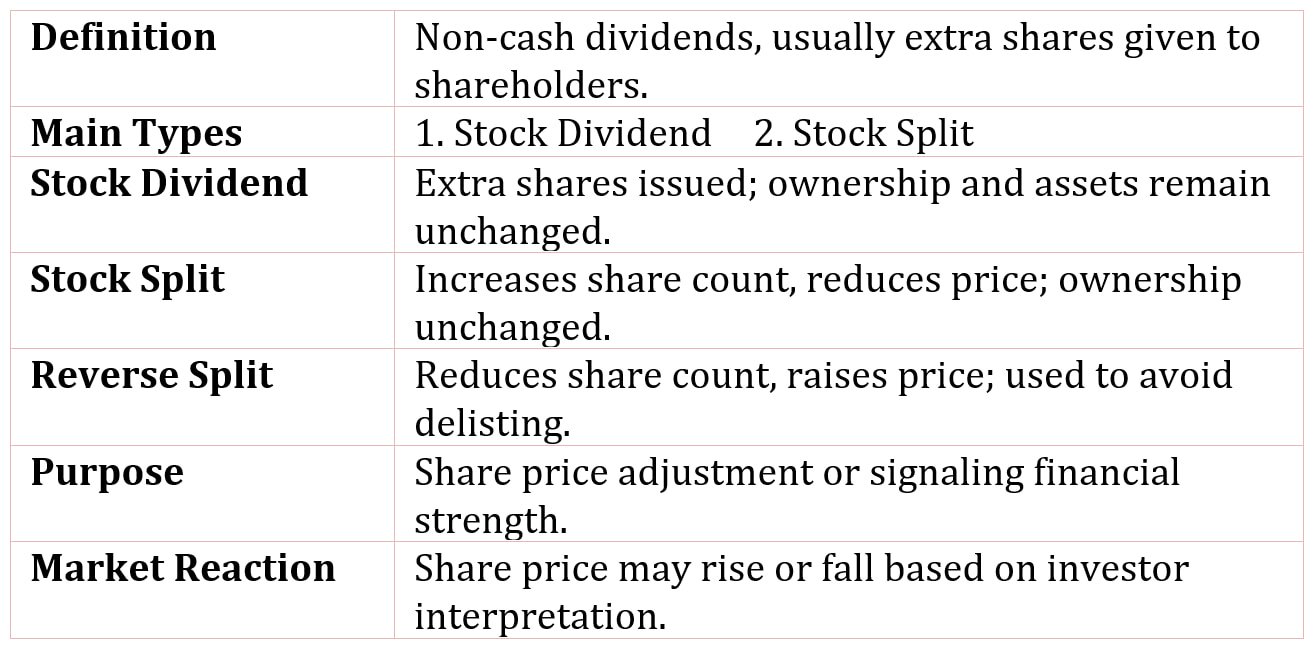

Stock distributions refer to non-cash dividends provided by a corporation to its shareholders, typically in the form of additional shares of the company’s own stock.

In addition to cash dividends, a corporation may provide shareholders with dividends in the form of additional shares of stock or, rarely, some types of property owned by the corporation. When dividends are not in cash, they are usually additional shares of stock.

Additional shares of stock can be distributed to shareholders in two ways:

- Paying a stock dividend

- Splitting the stock

Types of Distributions

A stock dividend is the distribution of additional shares of stock to shareholders. Stock dividends are generally stated as a percentage of existing share holdings. If a corporation pays a stock dividend, it is not transferring anything of value to the shareholders.

The assets of the corporation remain the same and each shareholder’s proportionate share of ownership remains the same. All the corporation is doing is cutting its equity “pie” into more slices and at the same time cutting each shareholder’s portion of that equity into more slices. So why pay a stock dividend?

A stock split is something like a stock dividend. A stock split splits the number of existing shares into more shares. For example, in a 2:1 split-referred to as “two for one”-each shareholder gets two shares for every one owned. If an investor owns 1,000 shares and the stock is split 2:1, the investor then owns 2,000 shares after the split. Has the portion of the investor’s ownership in the company changed? No, the investor now simply owns twice as many shares-and so does every other shareholder. If the investor owned 1% of the corporation’s stock before the split, the investor still owns 1% after the split.

A reverse stock split is similar to a stock split, but backwards: a 1:2 reverse stock split reduces the number of shares of stock such that a shareholder receives half the number of shares held before the reverse stock split.

A stock split in which more shares are distributed to shareholders is sometimes referred to as a forward stock split to distinguish it from a reverse stock split. Similar to both the stock dividend and the stock split, there is no actual distribution or contribution made, but simply a division of the equity pie-in this case, into fewer pieces.

Stock distributions, similar to cash dividends, are a decision of the board of directors, but in this case the “payment” date is similar when the additional shares are provided to shareholders, or shares exchanged, in the case of a forward or a reverse stock split.

Reasons for Stock Distributions

There are a couple of reasons for paying dividends in the form of stock dividends. One is to provide information to the market. A company may want to communicate good news to the shareholders without paying cash. For example, if the corporation has an attractive investment opportunity and needs funds for it, paying a cash dividend doesn’t make any sense-so the corporation pays a stock dividend instead. But is this an effective way of communicating good news to the shareholders? It costs very little to pay a stock dividend-just minor expenses for recordkeeping, printing, and distribution. But if it costs very little, do investors really trust it as a signal?

Another reason given for paying a stock dividend is to reduce the price of the stock. If the price of a stock is high relative to most other stocks, there may be higher costs related to investors’ transactions of the stock, as in a higher broker’s commission. By paying a stock dividend-which slices the equity pie into more pieces-the price of the stock should decline. Let’s see how this works. Suppose an investor owns 1,000 shares, each worth $50 per share, for a total investment of $50,000. If the corporation pays the investor a 5% stock dividend, the investor then owns 1,050 shares after the dividend.

Is there is any reason for your holdings to change in value? Nothing economic has gone on here-the company has the same assets, the same liabilities, and the same equity-total equity is just cut up into smaller pieces. There is no reason for the value of the portion of the equity this investor owns to change. But the price per share should decline: from $50 per share to $47.62 per share. The argument for reducing the share price only works if the market brings down the price substantially, from an unattractive trading range to a more attractive trading range in terms of reducing brokerage commissions and enabling small investors to purchase even lots of 100 shares.

So why split? Like a stock dividend, the split reduces the trading price of shares. If an investor owns 1,000 shares of the stock trading for $50 per share prior to a 2:1 split, the shares should trade for $25 per share after the split.

Aside from a minor difference in accounting, stock splits and stock dividends are essentially the same. The stock dividend requires a shift within the stockholders’ equity accounts, from retained earnings to paid-in capital, for the amount of the distribution; the stock split requires only a memorandum entry. A 2:1 split has the same effect on a stock’s price as a 100% stock dividend, a 1.5 to 1 split has the same effect on a stock’s price as a 50% stock dividend, and so on.

The basis of the accounting rules is related to the reasons behind the distribution of additional shares. If companies want to bring down their share price, they tend to declare a stock split; if companies want to communicate news, they often declare a stock dividend.

Companies tend to reverse stock split when the stock’s price is extremely low, so low that they are at risk of being delisted from an exchange. A low stock price is a function of how many shares are outstanding, but mostly a function of poor performance which has led to a low share price.

How can investors tell what the motivation is behind stock dividends and splits? They cannot, but they can get a general idea of how investors interpret these actions by looking at what happens to the corporation’s share price when a corporation announces its decision to pay a stock dividend or split its stock, or reverse split.

If the share price tends to go up when the announcement is made, the decision is probably good news; if the price tends to go down, the stock dividend is probably bad news. This is supported by evidence that indicates corporation’s earnings tend to increase following stock splits and dividends.