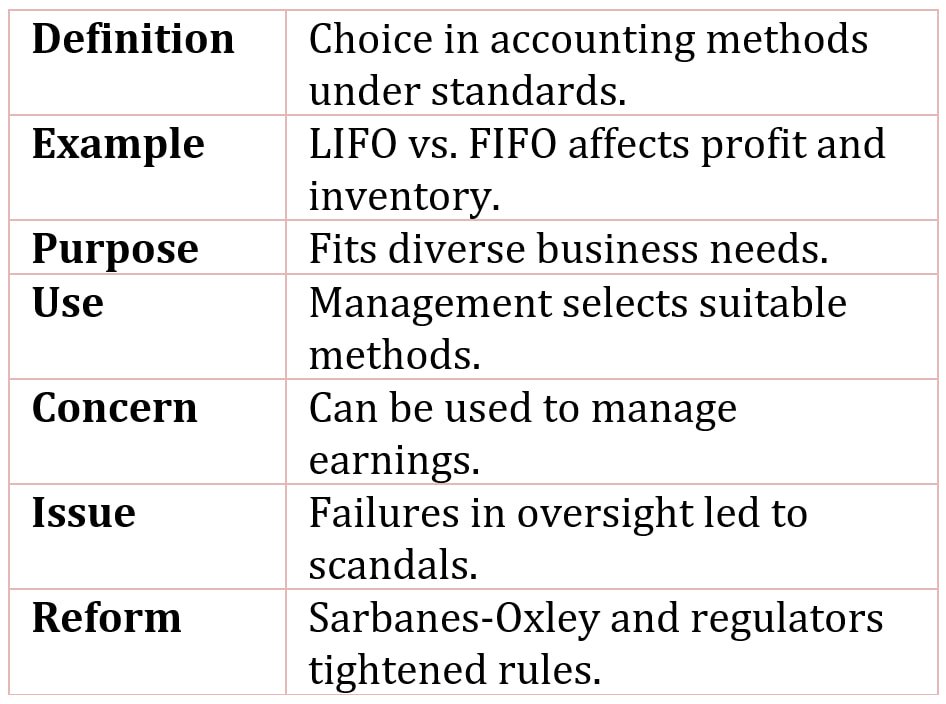

Accounting Flexibility

The accounting flexibility is the permitted choice of methods in financial reporting under accounting standards.

The generally accepted accounting principles provide some choices in the manner in which some transactions and assets are accounted.

For example, a company may choose to account for inventory, and hence costs of sales, using Last-in, First-out (LIFO) or First-in, First-out (FIFO).

LIFO uses the most recent inventory costs to determine cost of goods sold, while FIFO applies the oldest costs. This flexibility impacts reported earnings and inventory values. This is intentional because these principles are applied to a broad set of companies and no single set of methods offers the best representation of a company’s condition or performance for all companies.

Ideally, a company’s management, in consultation with the accountants, chooses those accounting methods and presentations that are most appropriate for the company.

A company’s management has always had the ability to manage earnings through the judicious choice of accounting methods within the GAAP framework.

The company’s “watchdogs” (i.e., the accountants) should keep the company’s management in check. However, recent scandals have revealed that the watchdog function of the accounting companies was not working well.

Additionally, some company’s management used manipulation of financial results and outright fraud to distort the financial picture.

The Sarbanes-Oxley Act of 2002 offers some comfort in terms of creating the oversight board for the auditing accounting companies.

In addition, the Securities and Exchange Commission, the Financial Accounting Standards Board, and the International Accounting Standards Board are tightening some of the flexibility that companies had in the past.