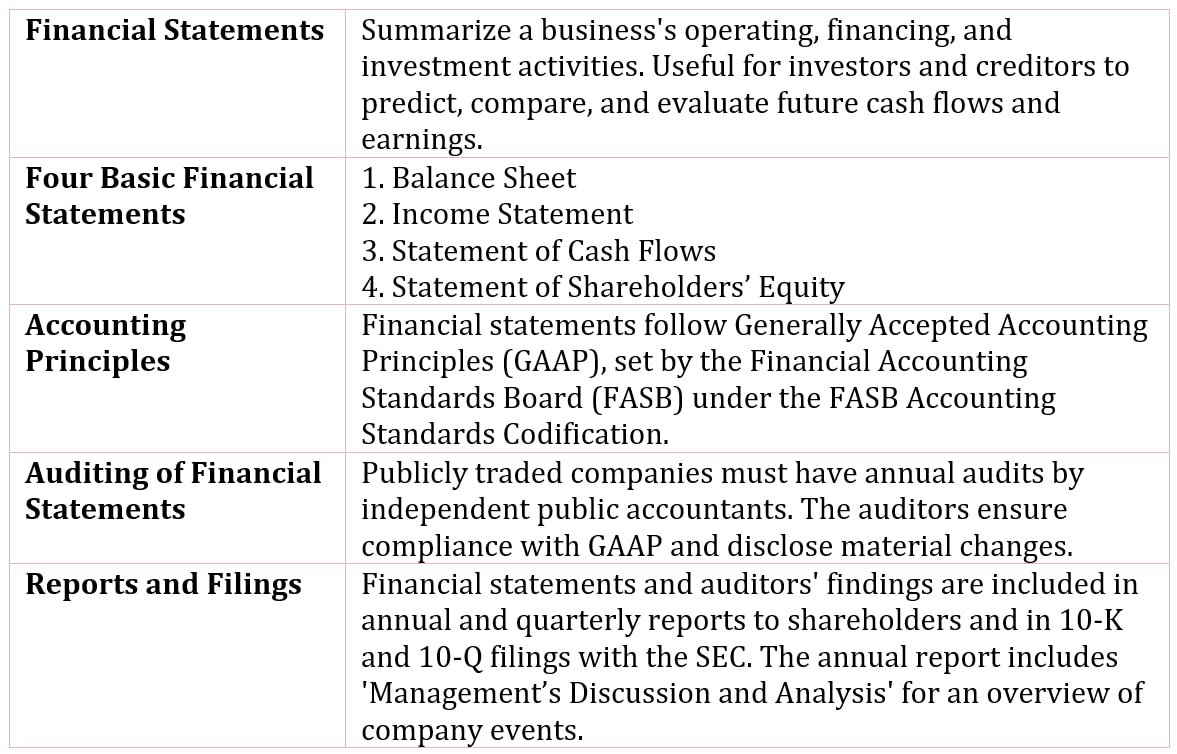

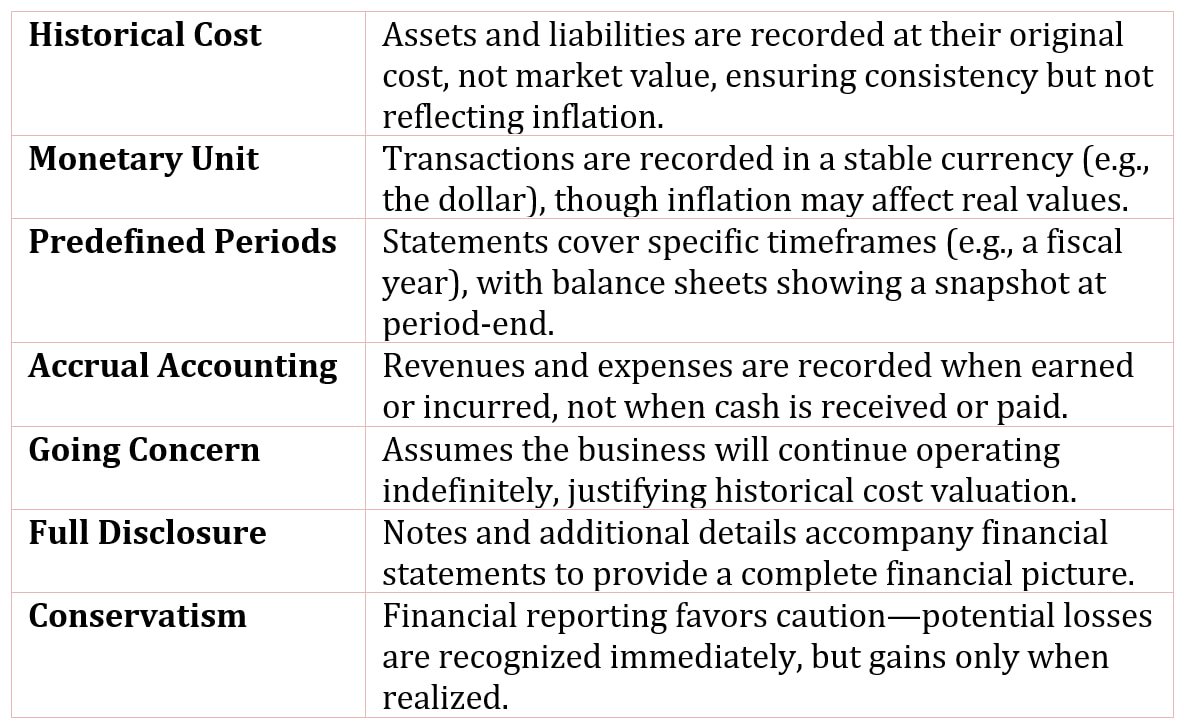

Table of Contents

Assets

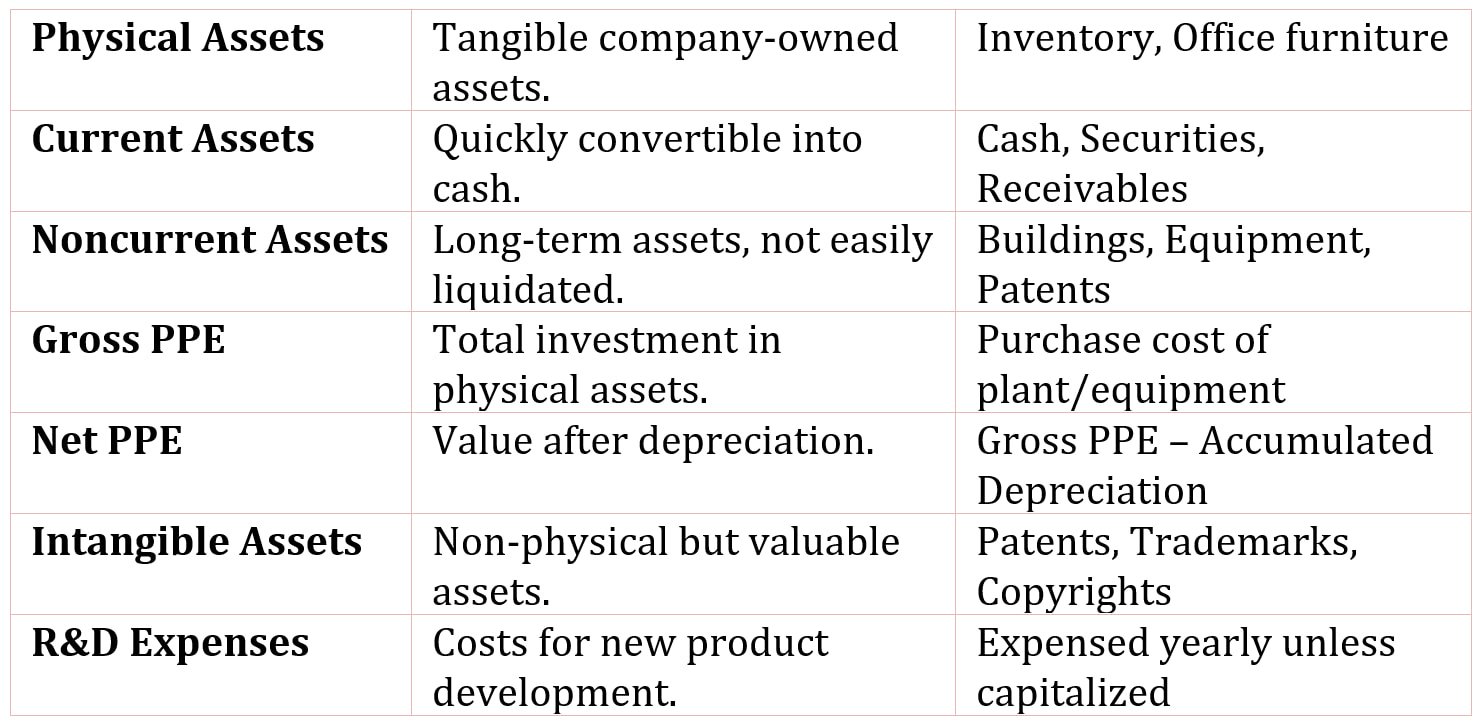

Assets are anything that the company owns that has a value. These assets may have a physical in existence or not.

Physical Assets

Tangible assets like inventory, office furniture, and production equipment.

Examples of physical assets:

- Include inventory items held for sale

- Office furniture

- Production equipment

If an asset does not have a physical existence, we refer to it as an intangible asset, such as a trademark or a patent. You cannot see or touch an intangible asset, but it still contributes value to the company.

Assets may also be current or long-term, depending on how fast the company would be able to convert them into cash.

Assets are generally reported in the balance sheet in order of liquidity, with the most liquid asset listed first and the least liquid listed last.

The most liquid assets of the company are the current assets.

Current Assets

Current assets are assets that can be turned into cash in one operating cycle or one year, whichever is longer. This contrasts with the noncurrent assets, which cannot be liquidated quickly.

There are different types of current assets. The typical set of current assets is the following:

- Cash, bills, and currency: are assets that are equivalent to cash (e.g., bank account).

- Marketable securities: which are securities that can be readily sold.

- Accounts receivable: which are amounts due from customers arising from trade credit.

- Inventories: which are investments in raw materials, work-in-process, and finished goods for sale.

The Operating Cycle

A company’s need for current assets is dictated, in part, by its operating cycle.

The operating cycle is the length of time it takes to turn the investment of cash into goods and services for sale back into cash in the form of collections from customers.

The longer the operating cycle, the greater a company’s need for liquidity. Most companies’ operating cycle is less than or equal to one year.

Noncurrent assets (Plant Assets)

Noncurrent assets comprise both physical and nonphysical assets.

Plant assets are physical assets, such as buildings and equipment and are reflected in the balance sheet as gross plant and equipment and net plant and equipment.

Gross Property, Plant, and Equipment (PPE)

Gross plant and equipment, or gross property, plant, and equipment, is the total cost of investment in physical assets; that is, what the company originally paid for the property, plant, and equipment that it currently owns.

Net Property, Plant, and Equipment (Net PPE)

Net plant and equipment, or net property, plant, and equipment, is the difference between gross plant and equipment and accumulated depreciation, and represents the book value of the plant and equipment assets.

Accumulated Depreciation

Accumulated depreciation is the sum of depreciation taken for physical assets in the company’s possession.

Companies may present just the net plant and equipment figure on the balance sheet, placing the detail with respect to accumulated depreciation in a footnote. Interpreting financial statements requires knowing a bit about how assets are depreciated for financial reporting purposes.

Intangible Assets

Intangible assets are assets that are not financial instruments, yet have no physical existence, such as patents, trademarks, copyrights, franchises, and formulae.

Intangible assets may be amortized over some period, which is akin to depreciation. Keep in mind that a company may own a number of intangible assets that are not reported on the balance sheet.

A company may only include an intangible asset’s value on its balance sheet if:

- There are likely future benefits attributable specifically to the asset.

- The cost of the intangible asset can be measured.

Research and Development Expenses

Suppose a company has an active, ongoing investment in research and development to develop new products.

It must expense what is spent on research and development each year because for a given investment in R&D does not likely meet the two criteria because it is not until much later, after the R&D expense is made, that the economic viability of the investment is determined.

If, on the other hand, a company buys a patent from another company, this cost may be capitalized and then amortized over the remaining life of the patent. So when you look at a company’s assets on its balance sheet, you may not be getting the complete picture of what it owns.