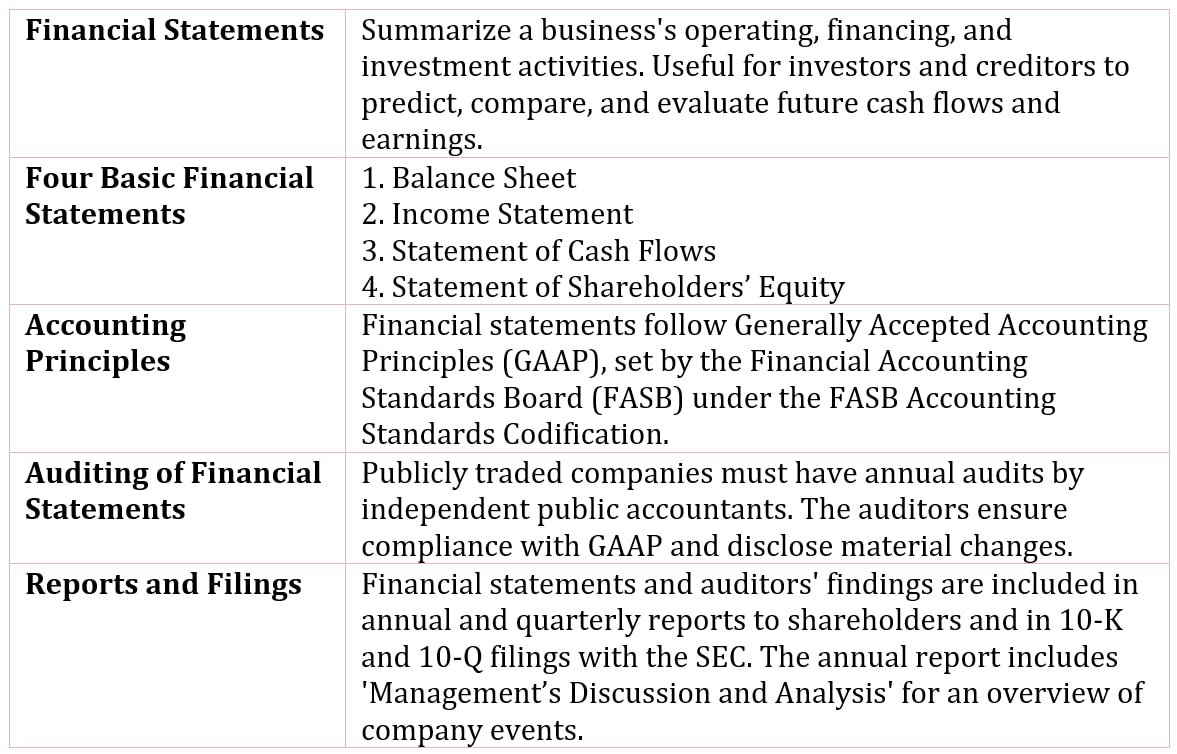

Table of Contents

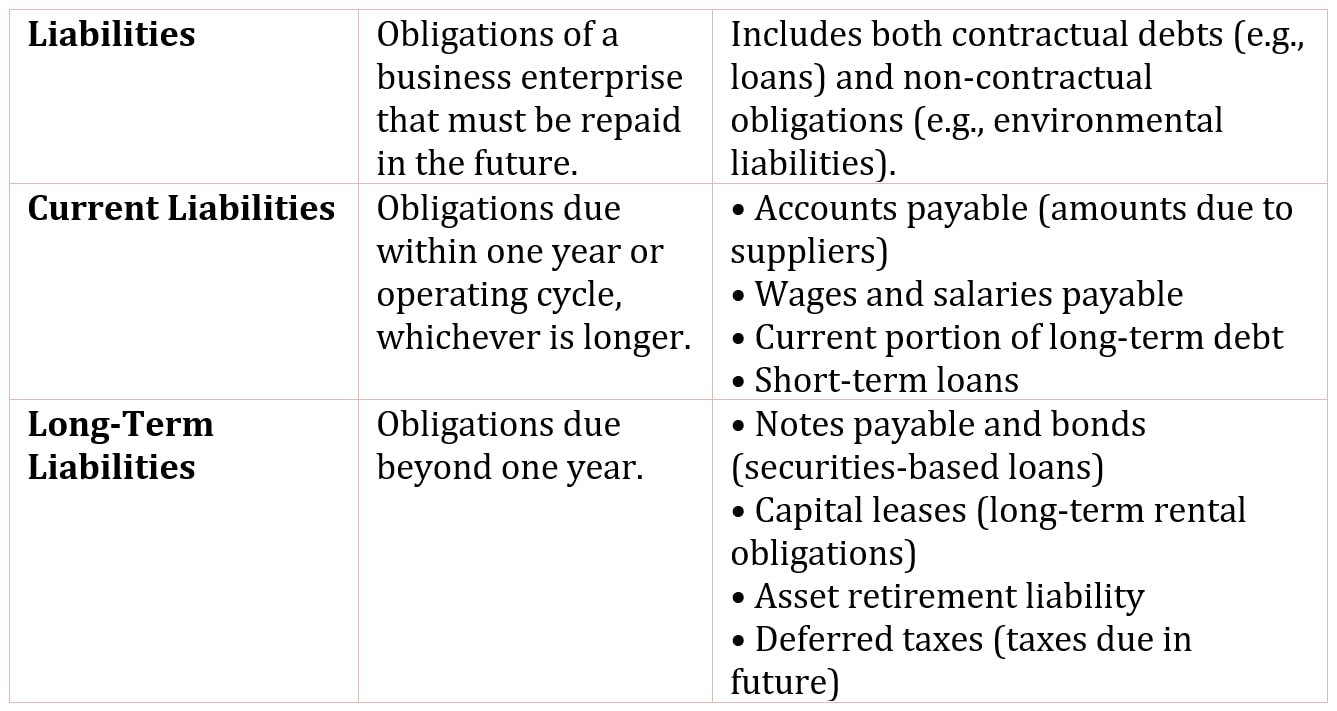

Liabilities

Liabilities are obligations of the business enterprise that must be repaid at a future point in time.

We generally use the terms “liability” and “debt” as synonymous terms, though “liability” is actually a broader term, encompassing not only the explicit contracts that a company has, in terms of short term and long-term debt obligations, but also includes obligations that are not specified in a contract, such as environmental obligations or asset retirement obligations.

Liabilities may be interest bearing, such as a bond issue, or non-interest bearing, such as amounts due to suppliers.

In the balance sheet, liabilities are presented in order of their due date and are often presented in two categories:

- Current liabilities

- Long term liabilities

Current Liabilities

Current liabilities are obligations due within one year or one operating cycle (whichever is longer).

Current liabilities may consist of:

- Accounts payable, amounts due to suppliers for purchases on credit

- Wages and salaries payable, amounts due employees

- Current portion of long-term indebtedness

- Short term bank loans

Long-term liabilities are obligations that are due beyond one year.

Long Term Liabilities

There are different types of long-term liabilities, including:

- Notes payables and bonds, which are indebtedness (loans) in the form of securities.

- Capital leases, which are rental obligations that are long-term, fixed commitments.

- Asset retirement liability, which is the contractual or statutory obligation to retire or decommission an asset at the end of the asset’s life and restore the site to required standards.

- Deferred taxes, which are taxes that may have to be paid in the future that are currently not due, though they are expensed for financial reporting purposes. Deferred taxes arise from differences between accounting and tax methods (e.g., depreciation methods).