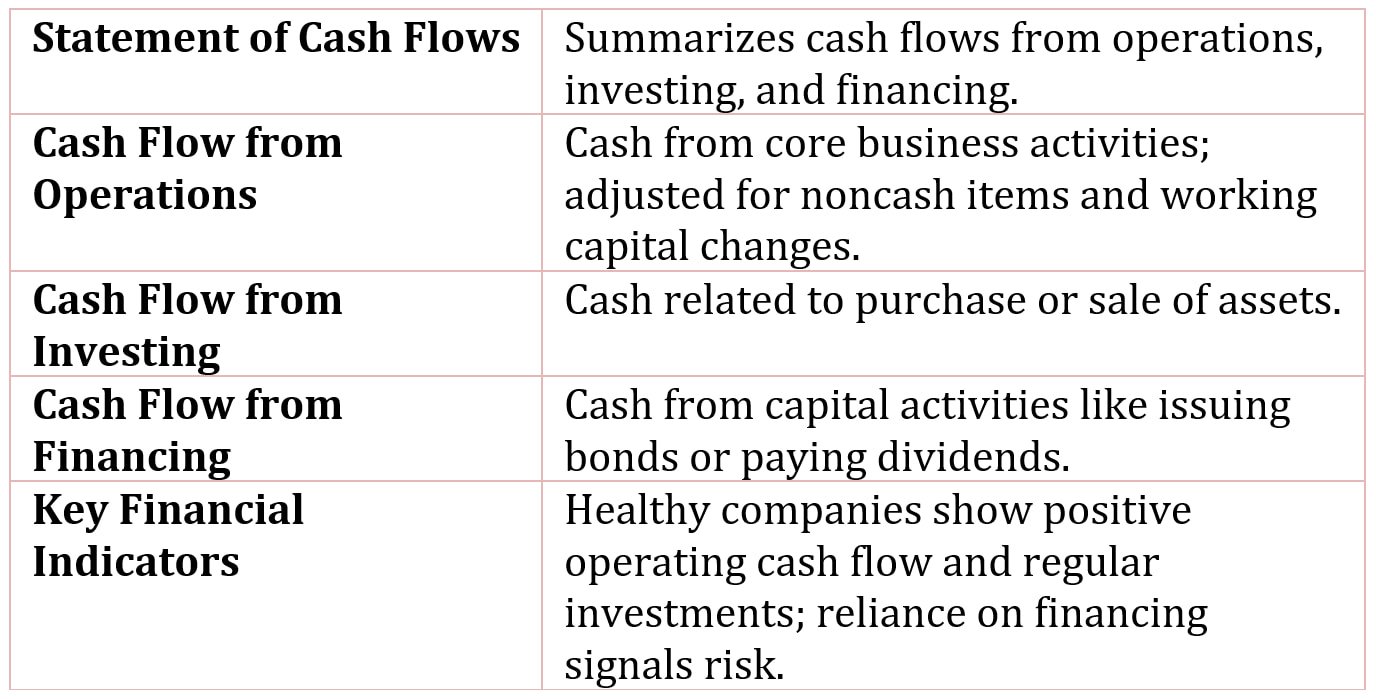

The Statement of Cash Flows

The statement of cash flows is the summary of a company’s cash flows, summarized by operations, investment activities, and financing activities.

Cash flow from operations is cash flow from day-to-day operations.

Cash flow from operating activities is basically net income adjusted For:

- Noncash expenditures

- Changes in working capital accounts

The adjustment for changes in working capital is necessary to convert net income, calculated using the accrual method, into actual cash flow.

- Increases in current assets and decreases in current liabilities are positive adjustments.

- Decreases in current assets and increases in current liabilities are negative adjustments.

Cash flow for/from investing is the cash flows related to the acquisition (purchase) of plant, equipment, and other assets, as well as the proceeds from the sale of assets.

Cash flow for/from financing activities is the cash flow from activities related to the sources of capital funds (e.g., buyback common stock, pay dividends, issue bonds).

The sources of a company’s cash flows can reveal a great deal about the company and its prospects.

For example, a financially healthy company tends to consistently generate cash flows from operations (that is, positive operating cash flows) and invests cash flows (that is, negative investing cash flows). To remain viable, a company must be able to generate funds from its operations; to grow, a company must continually make capital investments.

By studying the cash flows of a company over time, we can gauge a company’s financial health.

For example, if a company relies on external financing to support its operations (that is, reliant on cash flows from financing and not from operations) for an extended period of time, this is a warning sign of financial trouble up ahead.