Table of Contents

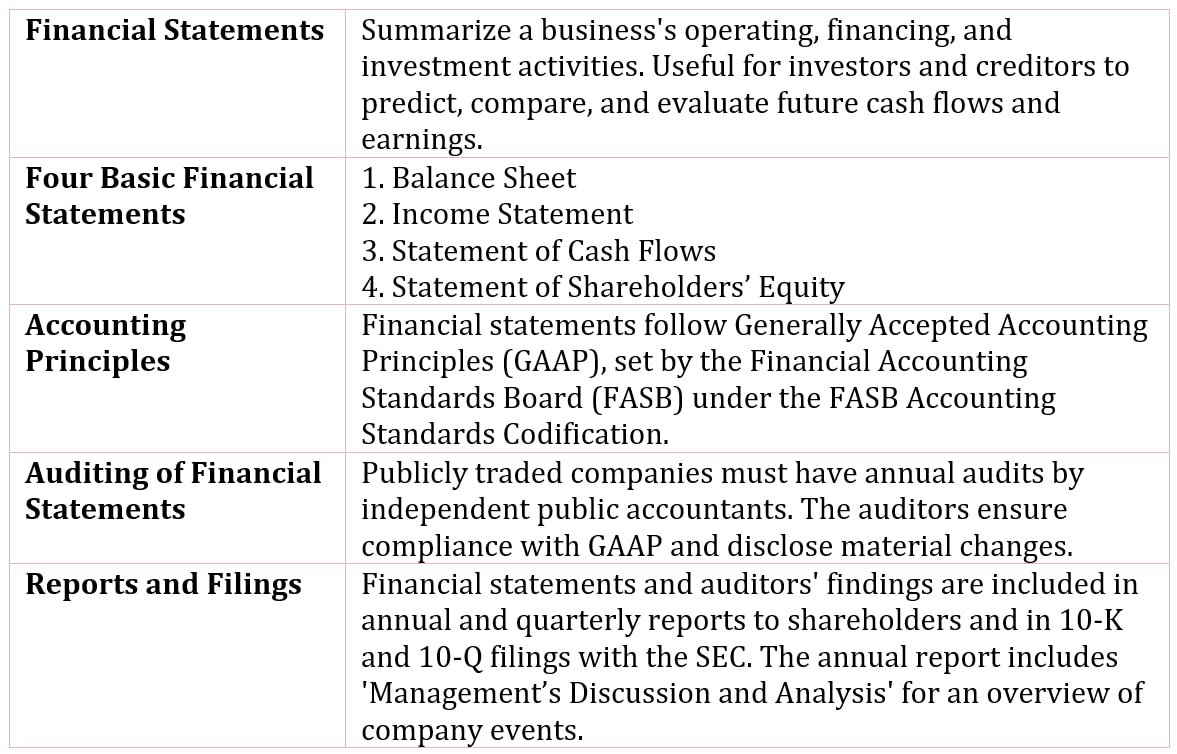

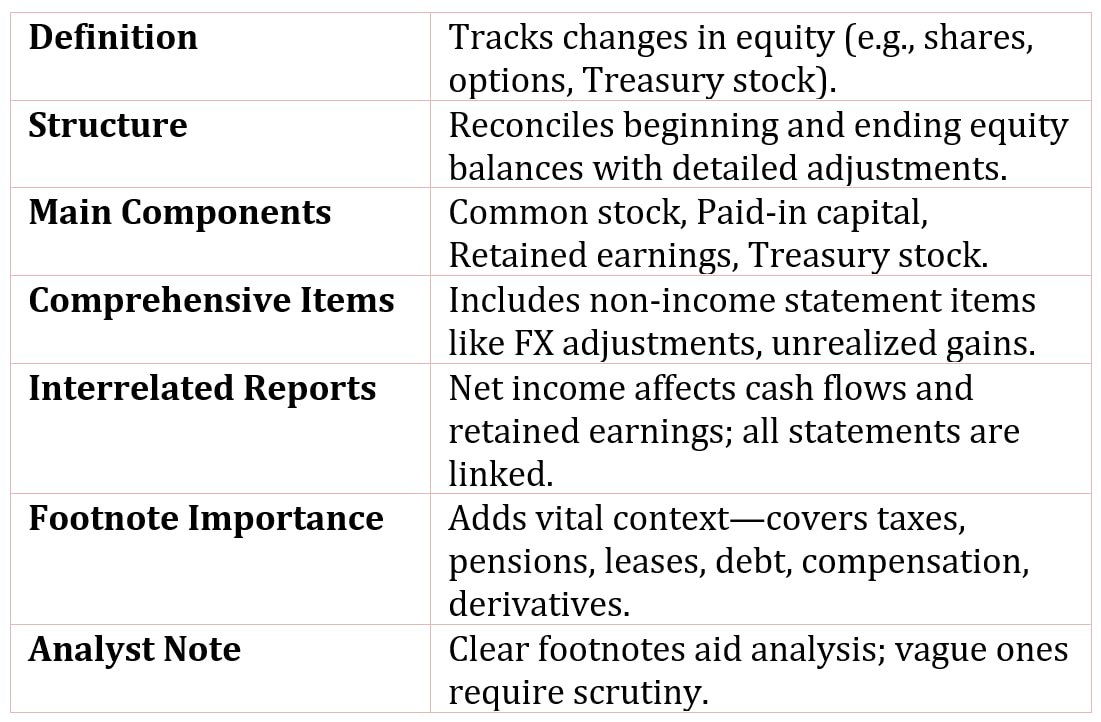

The Statement of Stockholder’s Equity

The statement of stockholder’s equity (also referred to as the statement of shareholders’ equity) is a summary of the changes in the equity accounts, including information on stock options exercised, repurchases of shares, and treasury shares.

The basic structure is to include a reconciliation of the balance in each component of equity from the beginning of the fiscal year with the end of the fiscal year, detailing changes attributed to net income, dividends, purchases or sales of treasury stock.

The components are:

- Common stock

- Additional paid-in capital

- Retained earnings

- Treasury stock

For each of these components, the statement begins with the balance of each at the end of the previous fiscal period and then adjustments are shown to produce the balance at the end of the current fiscal period.

In addition, there is a reconciliation of any gains or losses that affect stockholder’s equity but which do not flow through the income statement, such as foreign-currency translation adjustments and unrealised gains on investments.

These items are of interest because they are part of comprehensive income, and hence income to owners, but they are not represented on the company’s income statement.

How are the Statement Related?

The four basic statements are the result of transactions that record each activity of the company. As a result, the financial statements are inter-related.

For example:

- The change in cash, the bottom line of the statement cash flows, is equal to the change in the cash balance from the previous fiscal period to the current fiscal period.

- Net income, the bottom line of the income statement, is the starting point of the statement of cash flows, and contributes to retained earnings in the balance sheet and the statement of shareholder’s equity.

- The changes in the working capital accounts are adjustments to the arrive at the cash flow from operating activities in the statement of cash flows, the changes in the asset accounts contribute to changes in cash flows from investing activities, and debt issuances and repayments, as well as issuance or repurchase of stock contribute to the change in cash flows for financing activities.

Why Bother about the Footnotes ?

Footnotes to the financial statements contain additional information, supplementing or explaining financial statement data. These notes are presented in both the annual report and the 10-K filing (with the SEC), though the latter usually provides a greater depth of information.

The footnotes to the financial statements provide information pertaining to:

- The significant accounting policies and practices that the company uses: This helps the analyst with the interpretation of the results, comparability of the results to other companies and to other years for the same company, and in assessing the quality of the reported information.

- Income taxes: The footnotes tell us about the company’s current and deferred income taxes, breakdowns by the type of tax (e.g., federal versus state), and the effective tax rate that the company is paying.

- Pension plans and other retirement programs: The detail about pension plans, including the pension assets and the pension liability, is important in determining whether a company’s pension plan is overfunded or underfunded.

- Leases: You can learn about both the capital leases, which are the longterm lease obligations that are reported on the balance sheet, and about the future commitments under operating leases, which are not reflected on the balance sheet.

- Long-term debt: You can find detailed information about the maturity dates and interest rates on the company’s debt obligations.

- Stock-based compensation: You can find detailed information about stock options granted to officers and employees. This footnote also includes company’s accounting method for stock-based compensation and the impact of the method on the reported results.

- Derivative instruments: This describes accounting policies for certain derivative instruments (financial and commodity derivative instruments), as well as the types of derivative instruments.

The phrase “the devil is in the details” applies aptly to the footnotes of a company’s financial statement.

Through the footnotes, a company is providing information that is crucial in analyzing a company’s financial health and performance.

If footnotes are vague or confusing, as they were in the case of Enron prior to the break in the scandal, the analyst must ask questions to help understand this information.