Table of Contents

U.S. Accounting VS. Outside of the U.S.

A comparison of U.S. GAAP with international standards like IFRS, focusing on differences in rules, valuation, and reporting.

The generally accepted accounting standards in the United States (U.S. GAAP) differ from those used in other countries around the world. But not for long.

What is happening is an international convergence of accounting standards.

- The first major step was the agreement in 2002 between two major standard setting bodies-the U.S.’s Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB)-to work together for eventual convergence of accounting principles.

- The second major step was the requirement of International Financial Reporting Standards (IFRS) by the European Commission, effective in 2005.

- The third major step is the voluntary application of IFRS by U.S. domiciled companies for fiscal years ending after December 15, 2009.

Differences Between U.S. GAAP and IFRS

IFRS are promulgated by the IASB and must be used by all publicly traded and private companies in the European Union. IFRS are also used, in varying degrees, by companies in Australia, Hong Kong, Russia, and China.

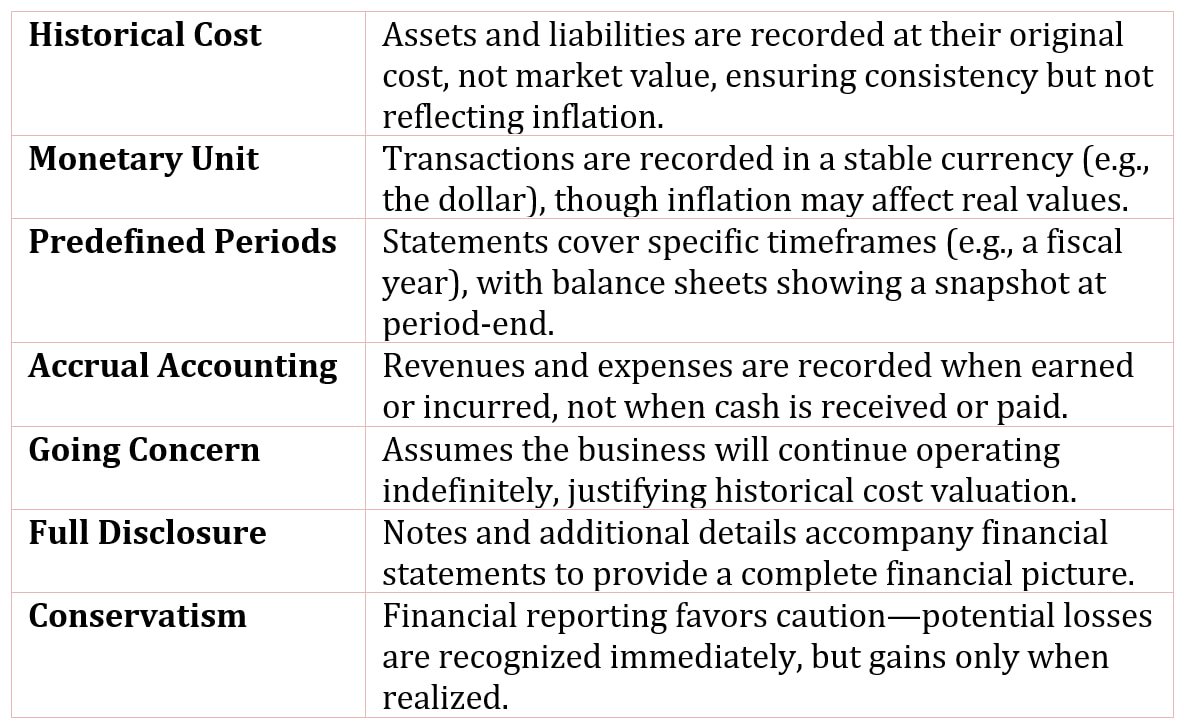

There are more similarities than differences between IFRS and U.S. GAAP. IFRS, like GAAP, uses historical cost as the main accounting convention. However, IFRS permits the revaluation of intangible assets, property, plant, and equipment, and investment property.

IFRS also requires fair valuation of certain categories of financial instruments and certain biological assets. U.S. GAAP, on the other hand, prohibits revaluations except for certain categories of financial instruments, which must be carried at fair value, and goodwill, which is tested each year for impairment (that is, a loss of value).

Because there has been a long “road map” to convergence, and because many of the accounting principles issued in the past few years have been issued jointly by FASB and IASB, convergence, when it happens, should not result in a dramatic change in the financial statements of U.S. companies.