Table of Contents

Comparative and Competitive Advantages in Finance

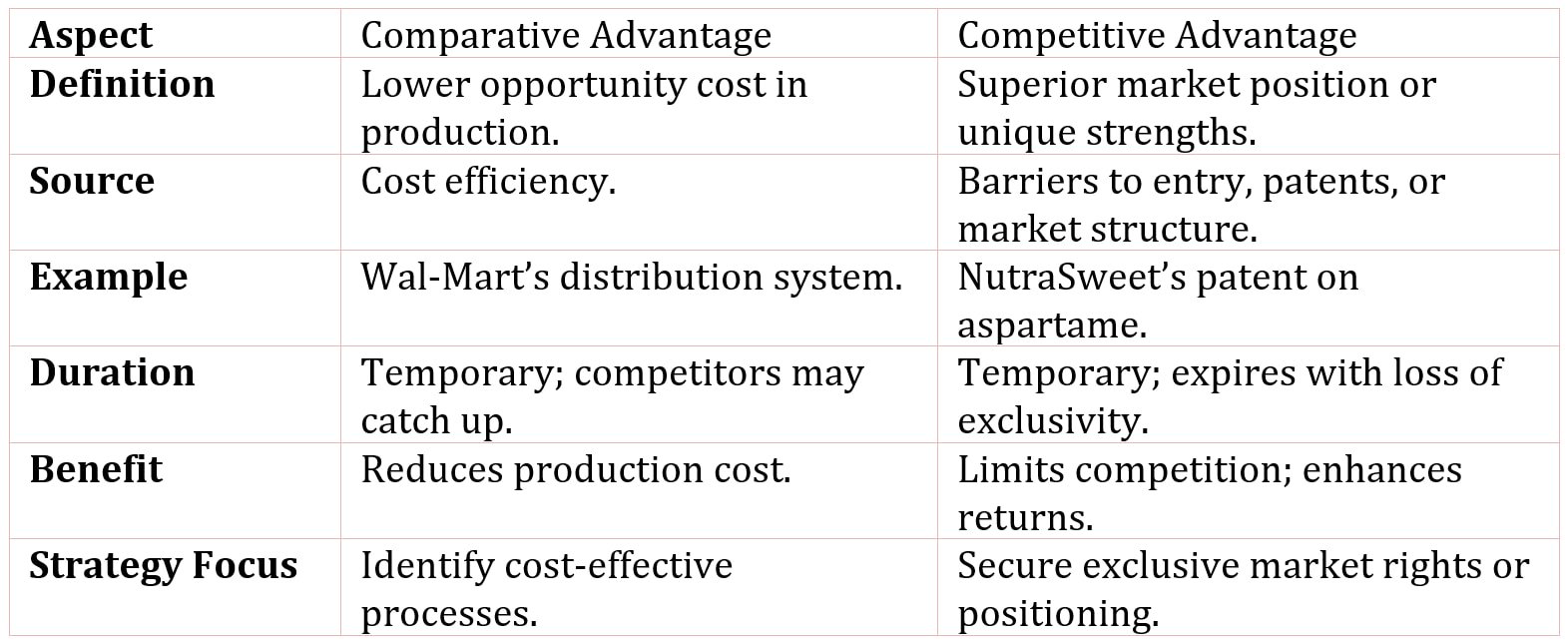

Comparative advantage refers to producing goods or services at a lower opportunity cost, while competitive advantage arises from favourable market positioning or unique strengths that outperform rivals.

Comparative Advantage

A comparative advantage is the advantage one company has over others in terms of the cost of producing or distributing goods or services. For example, Wal-Mart Stores, Inc. had for years a comparative advantage over its competitors (such as Kmart) through its vast network of warehouses and its distribution system. Wal-Mart invested in a system of regional warehouses and its own trucking system.

Combined with bulk purchases and a unique customer approach, Wal-Mart’s comparative advantages in its warehousing and distribution systems helped it grow to be a major (and very profitable) retailer in a very short span of time. However, as with most comparative advantages, it took a few years for competitors to catch up and for Wal-Mart’s advantages to disappear.

Competitive Advantage

A competitive advantage is the advantage one company has over another because of the structure of the markets, input and output markets, in which they both operate. For example, one company may have a competitive advantage due to barriers to other companies entering the same market. This happens in the case of governmental regulations that limit the number of companies in a market, as with banks, or in the case of government-granted monopolies.

A company itself may create barriers to entry (although with the help of the government) that include patents and trademarks. NutraSweet Company, a unit of Monsanto Company, had the exclusive patent on the artificial sweetener, aspartame, which it marketed under the brand name NutraSweet. However, this patent expired December 14, 1992.

The loss of the monopoly on the artificial sweetener reduced the price of aspartame from $70 per pound to $20 to $35 per pound, since other companies could produce and sell aspartame products starting December 15, 1992.

NutraSweet had a competitive advantage as long as it had the patent. But as soon as the patent expired, this competitive advantage was lost and competitors were lining up to enter the market. Estimates of the value of patents vary by country and industry, but studies have shown that up to one quarter of the return from research and development is attributed to patents.

The bottom line is that a company invests in something and gets more back in return only by having some type of advantage. In other words, a comparative or competitive advantage allows the company to generate economic profits-that is, profits in excess of its cost of capital. So first a management has to figure out where the company has a comparative or competitive advantage before the company’s strategy can be determined.