Table of Contents

Performance Evaluation in Finance

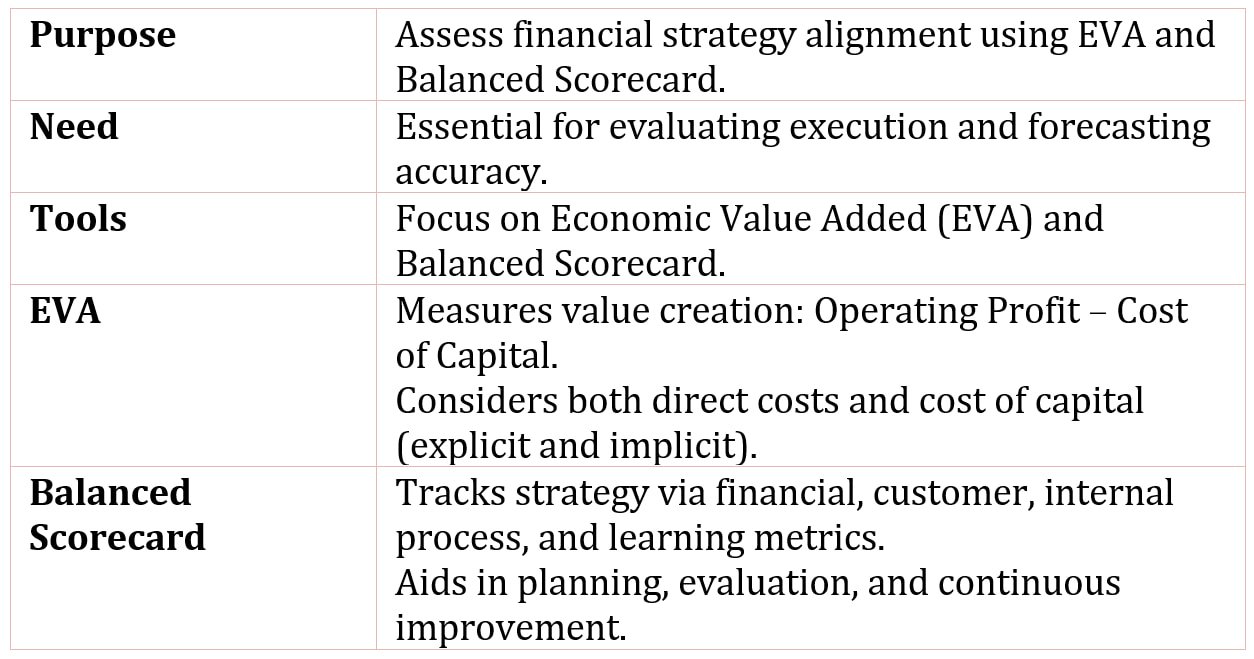

Performance evaluation in finance is the process of assessing how well financial strategies and decisions meet organizational goals, using tools like Economic Value Added (EVA) and the Balanced Scorecard to measure profitability, efficiency, and strategic alignment.

Planning and forecasting are important, but without some type of performance evaluation, the execution of a strategy and the accuracy of forecasting cannot be addressed.

There are many performance evaluation measures and systems available. We will address two of these, economic value added and the balanced scorecard, to provide examples of how these may assist in assessing performance.

Economic Value Added

Arising from the need for better methods of evaluating performance, several consulting companies advocate performance evaluation methods that are applied to evaluate a company’s performance as a whole and to evaluate specific manager’s performances. These methods are, in some cases, supplanting traditional methods of measuring performance, such as the return on assets discussed in other chapters of this book.

As a class, these measures are often referred to as value-based metrics or economic value–added measures. There is a cacophony of acronyms to accompany these measures, including economic value added (EVAR), market value added (MVA), cash flow return on investment (CFROI), shareholder value added (SVA), cash value added (CVA), and refined economic value added (REVA).

A company’s management creates value when decisions provide benefits that exceed the costs. These benefits may be received in the near or distant future. The costs include both the direct cost of the investment as well as the less obvious cost, the cost of capital.

The cost of capital is the explicit and implicit costs associated with using investor’s funds. The attention to the cost of capital sets the value-based metrics apart from traditional measures of performance such as the return on investment.

There are a number of value-added measures available. The most commonly used measures are economic value added and market value added. Economic value added, also referred to as economic profit, is the difference between operating profits and the cost of capital, where the cost of capital is expressed in dollar terms.

The difference between the operating profit and the cost of capital is the estimate of the company’s economic value added, or economic profit. The cost of capital is the rate of return required by the suppliers of capital to the company. For a business that finances its operations or investments using both debt and equity, the cost of capital includes not only the explicit interest on the debt, but also the implicit minimum return that owners require.

Balance Card

The traditional measures of a company’s performance are generally historical, financial measures. With the popularity of economic value added and market value measures, many companies began to adopt forward-looking financial measures. Taking a step further, many companies are adopting the concept of a balanced scorecard.

A balanced scorecard is a set of measures of performance that address different aspects of a company’s strategic plan.

A balanced scorecard is a management tool used to:

- Help put a company’s strategic plan into action.

- Use measurement devices to evaluate performance relative to the strategic plan.

- Provide feedback mechanisms to allow for continuous improvement toward the strategic goals.

The balanced scorecard is really a process of assessing the effectiveness of the company’s strategy in meeting the company’s objective, identifying measures to evaluate whether the company is meeting its short-term and long-term goals, setting targets, and then providing feedback from these measures.

The actual balanced scorecard does not prescribe the measures to use, but rather specifies the dimensions of the company that should be considered in the system.

The developers of the balanced scorecard argue that measures and metrics used to evaluate different business units and the company should represent different dimensions of performance, including financial performance, customer relations, internal business processes, and organizational learning and growth.